Trump Is Reviving a Great American Tariff Tradition

Now, the administration should heed Henry Clay’s warning on ‘specific’ tariffs.

Recently, and almost entirely unnoticed by the mainstream media, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) reopened a door that has been bolted shut since 1930. For the first time in nearly a century, U.S. producers were being asked simple, America First questions: What can we make more of here, in our own country? Which products need tariff protection?

Under an interim final rule that took effect April 30, manufacturers who use steel and aluminum to make things in America now have three, two-week windows every year—in May, September, and January—to request that products they make be added to the coverage of the existing steel and aluminum tariff actions.

Commerce Secretary Howard Lutnick is calling this the “Inclusion” process, and with it he is reviving straightforward and patriotic tariff dialogue for the first time in 95 years.

The Founders’ Intent: Open Dialogue, Not Litigation

This new inclusion process is not merely a bureaucratic tweak. It signals a conscious return to the system the Founders created under the Tariff Act of 1789, the first major bill passed by Congress. The first sentence of that Act read:

Whereas it is necessary for the support of government, for the discharge of the debts of the United States, and the encouragement and protection of manufacturers, that duties be laid on goods, wares and merchandise imported…

From that Tariff Act of 1789 to the last such act, the Tariff Act of 1930, the process was the same: producers testified about the competitive landscape of their industry, lawmakers weighed national interests against potential consumer costs, and rates were set product by product with “catch-all” rates for products not listed.

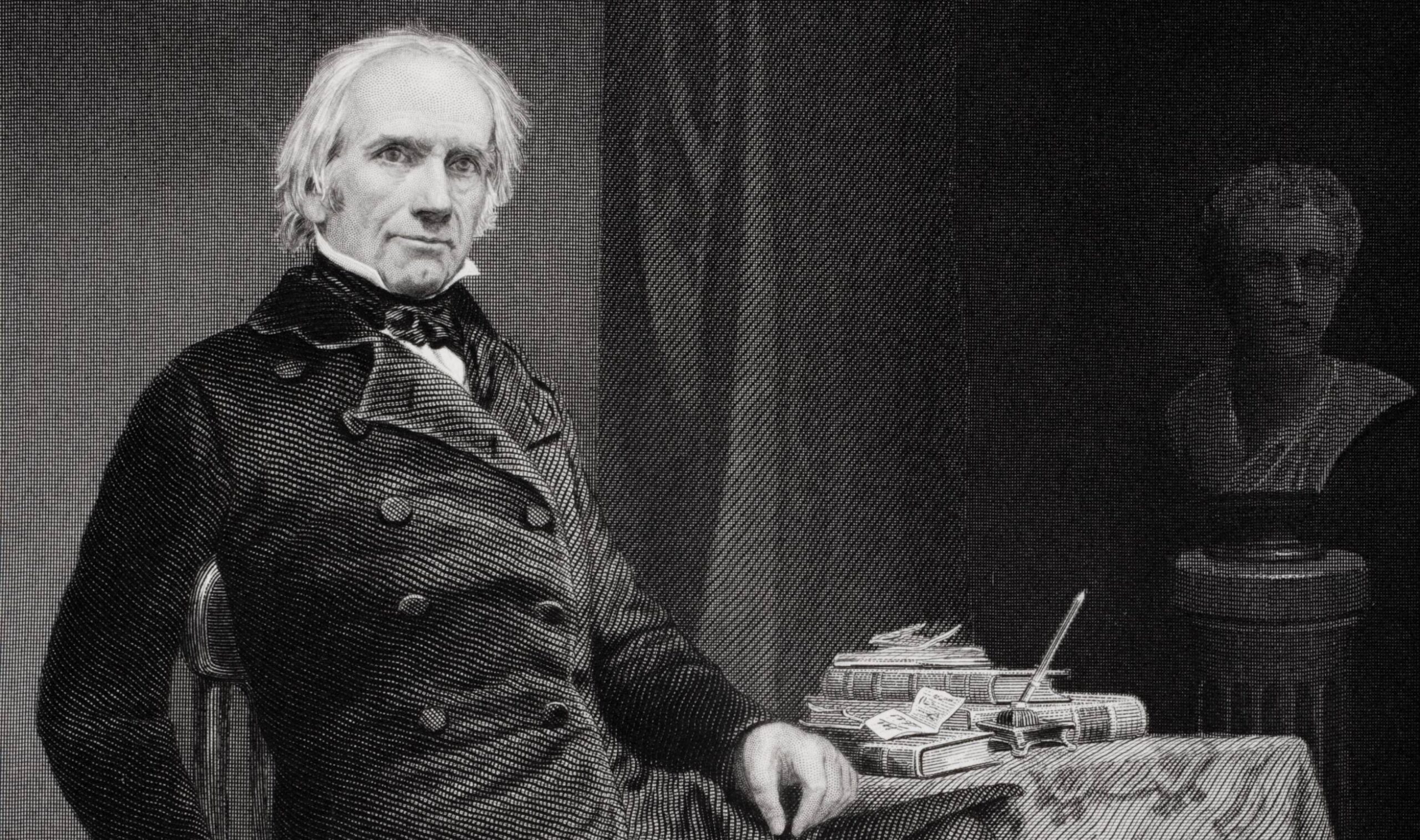

That practical give-and-take, with an unabashed bias to protecting and preserving the home market for domestic producers, was the key tenant of what Henry Clay and Abraham Lincoln later called “the American system,” which nurtured economic growth and turned the U.S. into an industrial powerhouse that was the envy of the world by 1900.

Under this American system, it was considered good and patriotic to protect U.S. producers. Politicians didn’t use language like “level the playing field” or talk about how “American workers can compete with anyone.” No, putting American workers in direct competition with lower-paid overseas workers was considered self-evidently ridiculous. William McKinley put it simply: “Open competition between high-paid American labor and poorly paid European labor will either drive out of existence American industry or lower American wages.”

Progressives in the early 20th century, however, began to take aim at protective tariffs as part of their animus towards the giant monopolies and trusts of the era.

President Woodrow Wilson, addressing a joint session of Congress in April 1913, argued that American businesses—and workers—should, actually, be in direct price competition with everyone, everywhere on Earth:

Aside from the duties laid upon articles which we do not, and probably cannot, produce, therefore, and the duties laid upon luxuries and merely for the sake of the revenues they yield, the object of the tariff duties henceforth laid must be effective competition, the whetting of American wits by contest with the wits of the rest of the world.

Wilson wasn’t persuaded by arguments, for example, from the Rice Association of America, that laborers on rice fields in America were paid $1.50 per day, while in British India and Burma “there is no wage paid.” The Rice Association pleaded:

to ask the American agriculturist, and from him on through the different variations of labor who handle rice, to ask them to put their industry on a basis where they will have to compete with the rice of the Asiatic countries is to invite and bring about annihilation of the industry.

Unfortunately, various political interests combined to eliminate protections, and Wilson’s view about unlimited price competition for businesses and laborers would become the law of the land once Democrats swept into power in 1932.

In 1934, Congress outsourced most tariff decisions to the State Department, and later, in 1947, to Geneva, placing American law under the shackles of the General Agreement on Tariffs and Trade (GATT). Under GATT rules, domestic producers hoping for tariff relief were left to contort themselves into very tight trade-law pigeonholes—antidumping, countervailing-duty, and safeguards—that required expensive lawyers and years of litigation while only offering temporary, ineffective relief.

Labor unions never had a chance. Pointing out that workers overseas couldn’t organize and were paid a fraction of American wages got you nowhere in the new, Geneva-headquartered “multilateral trade system.”

Lutnick’s Inclusion Rounds, however, have now delivered a mortal wound to Geneva’s machinations.

With the new system, a U.S. manufacturer, instead of needing to prove that a foreign rival sells “below cost,” or being forced to conjure up precise metrics by which a foreign subsidy offsets a “fair” price, can make a case for protection entirely familiar to producers from before 1934: one centered on human and industrial development, wages and employment, and national self-reliance here at home.

Contrast that with antidumping cases, which typically cost a minimum of $1 million to initiate and $5 million to arrive at an uncertain ruling, with reams of contradictory “evidence” thrust before a panel. The Trump administration’s new Inclusion process will be a boon to small businesses that could never afford expensive, uncertain litigation.

Even more important, the process restores dialogue between the U.S. government and American businesses. The Founders expected tariff rates to be set by elected officials and thus open to the input of the American people. And while the Constitution gives the ultimate power to set tariffs to Congress, the legislative branch relied on the executive to help set rates.

By inviting petitions thrice yearly, BIS re-institutionalizes this forgotten American tradition.

The One-Size-Fits-All Problem

None of this is to say the new version of this process is perfect. The interim rule dictates that every successful petition inherits the same duty imposed on raw steel and aluminum. This rate had been 25 percent, but that proved too low to provide protection to domestic steel and aluminum mills, so on Friday, President Donald Trump announced that the steel and aluminum tariffs would double to 50 percent.

This increase is a welcome development. But we can continue to improve. One key problem: For goods further downstream from core steel and aluminum products, the 50 percent levy applies only to the steel and aluminum content in the imported product.

How is that content supposed to be calculated? Well, that’s on the official FAQ. The answer: “The value of the steel/aluminum content should be determined in accordance with the principles of the [World Trade Organization’s] Customs Valuation Agreement…”

In practice, that effectively means the importer is supposed to ask its overseas vendor what they recall paying for the steel and aluminum. The 50 percent applies to that alleged price.

It’s an invitation to fraud, and should be discarded as soon as possible..

Bring Back ‘Specific’ and ‘Compound’ Tariffs

Ad valorem tariffs are those expressed as a percentage—and are assessed against a price the importer claims they paid abroad. The proof? An overseas invoice. A PDF.

As far back as 1842, the father of the American trade system, Henry Clay himself, warned against using ad valorem tariffs even for revenue, to say nothing of their lack of any protective effect:

It is evident that on the ad valorem principle, it is the foreigner who virtually fixes the actual amount of the duty paid. It is the foreigner who, by fixing that value, virtually legislates for us—and that in a case where his interest is directly opposed to that of our revenue. I say, therefore, that independently of all considerations of protection, independently of all ends or motives but the prevention of those infamous frauds which have been the disgrace of our customhouse—frauds in which the foreigner, with his double and triple and quadruple invoices, ready to be produced as circumstances may require, fixes the value of the merchandise taxed—every consideration of national dignity, justice, and independence, demands the substitution of home valuation in the place of foreign.

The Commerce Department is listening to Clay’s wisdom. The Inclusion Process continues to be refined, and Lutnick has encouraged public comments. For the next Inclusion Round, BIS should ask domestic producers for tariff rates that will ensure their domestic productive capacity is utilized. Doing so is good, patriotic, and compatible with the American tradition. Protect the home market.

Now, for high-value, capital-intensive goods, produced by a limited number of global equipment makers—like heavy trucks—an ad valorem tariff may well be sufficient.

But for most products, especially in industries filled with fly-by-night overseas vendors and imports, an ad valorem tariff assessed on whatever PDF the importer uploads will not limit imports and thus fail to advance BIS’ goal in the underlying tariff action. A 50 percent ad valorem tariff is much better, but as we saw with so many Chinese imports breezing through 125 percent, invoice fraud is child’s play. This is why Clay said that even for revenue purposes, ad valorem tariffs were beneath America’s dignity.

And while fixing the “only applies to content” defect is critical, Commerce should avoid assuming a 50 percent ad valorem will be sufficient for all steel and aluminum products, even if applied to the whole alleged value. America’s original tariff statutes were anything but flat. The Tariff Act of 1789 listed specific tariff rates on dozens and dozens of products: cheese, 4 cents per pound; boots, fifty cents per pair; coffee, two and a half cents per pound. Ad valorem tariffs were deployed for products not individually listed.

“Specific tariffs” are those that are assessed on a unit of volume, like the 1789 Act’s rates for cheese, boots, and coffee above. With specific tariffs, customs fraud is difficult, because the customs officer need only count or weigh the merchandise in front of him to assess the tariff.

We still have plenty of specific tariffs in use today, mostly on agricultural products, although because neither Congress nor any president has updated them for inflation since 1930, they’re all anachronistic.

“Compound tariffs” are those that combine both a specific-tariff element as well as an ad valorem. Flatware (cutlery) has had a compound tariff that has not been adjusted for inflation since 1930. In the current Inclusion Round, the last American producer of stainless-steel flatware—Sherrill Manufacturing—has petitioned to be added to steel’s tariff action. Sherill states that a compound tariff of 50 cents per-piece plus 25 percent is necessary for the steel tariff program’s goals.

What Comes Next

Subscribe Today

Get daily emails in your inbox

Because the inclusion mechanism sits within Section 232 of the Trade Expansion Act, future rounds can expand beyond steel and aluminum. The administration has already initiated Section 232 tariff actions for wood products, copper alloys, critical minerals, semiconductors, and drugs, which are all expected to have a similar Inclusion process. Each sector will now have a predictable forum, several times a year, to argue its case—without hiring a stable of trade lawyers schooled in Geneva.

The Trump administration, and Commerce’s BIS in particular, should be celebrated for this development so early in the term. It’s no small feat. For decades, Washington has dithered between neglect and panic—ignoring industrial decline until the last domestic producer left to complain is gone.

This September, when the next Inclusion Round begins, BIS should solicit comments and requests for specific tariff rates for particular products sufficient to fill domestic producers’ order books. President Trump can act on those recommendations via presidential proclamations. If he does, the Trump administration will have fully restored a vital American tradition that will cement the dawn of America’s golden age.