Enforce the Robinson-Patman Act for a Fairer Economy

The RPA is merely in a dormant state, and thus ready and capable of being revived and vigorously enforced.

Nobody likes bullies. Bullies take from others what is not theirs and frequently make unreasonable demands that give them preferential privileges by depriving someone of something valuable—the taking of another student’s lunch money is the quintessential example. In a safe school environment, bullies must face disciplinary action. Such restrictions allow students to attend school without fear, ultimately fostering beneficial social interactions instead of destructive ones. Students, therefore, are not allowed to engage in any kind of social interaction they desire. Instead, some kinds of social interactions are proscribed so that others may flourish. No one questions that such restrictions are prudent.

Antitrust laws operate similarly as a democratic codification of anti-bullying in the marketplace. For example, firms are not able to “compete” by using any method of competition they conceive. Property destruction, depriving dependent firms of an essential resource, or using privileged access to capital to price goods below cost to kill off rivals are all practices prohibited by our antitrust laws. These laws, in other words, channel corporate operations in a specific direction to compete fairly as based on commonly understood notions of morality.

The resurgence in antitrust enforcement under the Biden administration is a significant departure from every prior administration since the 1970s. Among other laudable actions, the Department of Justice has initiated a landmark antitrust lawsuit against Google that could restructure the entire digital advertising industry. The Federal Trade Commission has also initiated a rule to ban all non-compete agreements in the United States, liberating workers to choose a new employer and facilitating potentially over $300 billion in increased wages. The Biden administration can continue advancing its indelible mark on the arc of antitrust history and promote fairness and anti-bullying in our economy by reviving pioneering 1930s legislation that is little used today: the Robinson-Patman Act. Fortunately, the administration is already making strides to do just that.

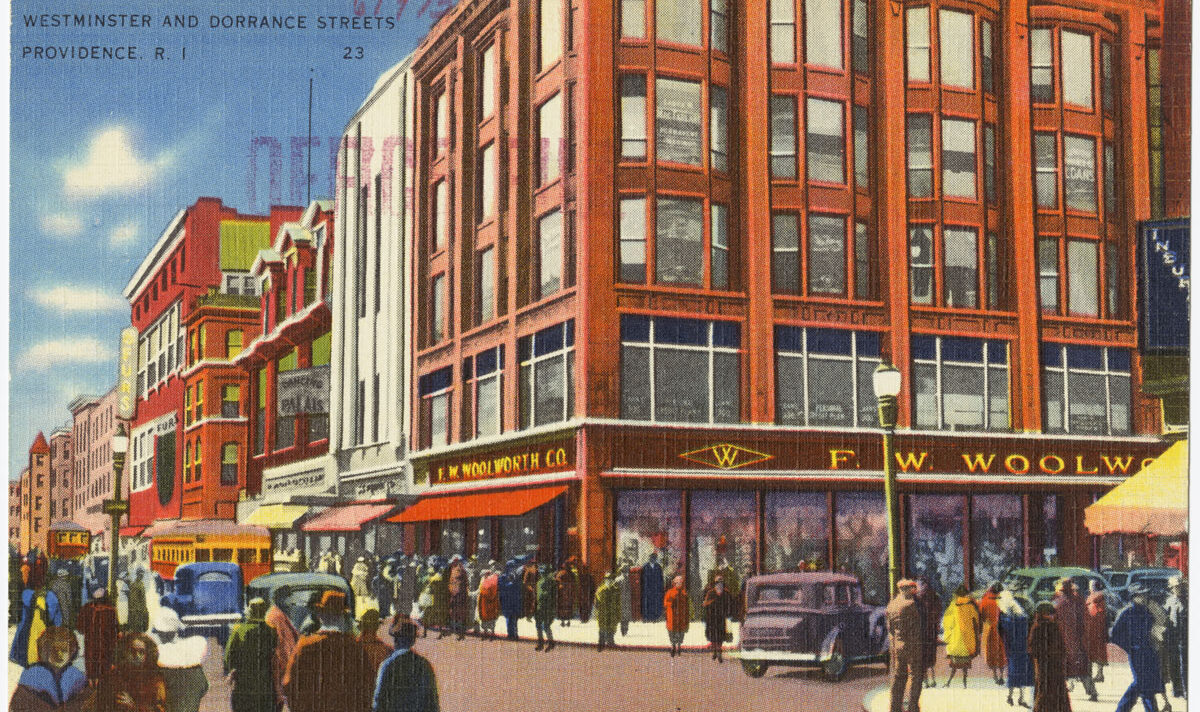

In 1936, Congress committed to anti-bullying and market fairness when it enacted the Robinson-Patman Act (RPA). At the time of its enactment, the U.S. was in the midst of the Great Depression, and the marketplace was dominated by powerful chain stores. Unlike local businesses, which are owned by members of the community, chain stores operate multiple outlets. In the 1930s, chain stores like JCPenney, Woolworths, Sears, and the Great Atlantic & Pacific Tea Company (more commonly known as A&P) operated thousands of outlets, designating them as some of the largest retailers in the world. By the middle of the 1930s, chain stores controlled approximately 25 percent of all retail sales and nearly 60 percent of grocery sales in the United States.

The success of the chain stores, however, was not solely the result of realizing economies of scale or pricing based on actual gains in efficiency of their operations. Instead, the chain stores decided to use their sheer size and purchasing power to coerce other dependent suppliers to give them highly preferential pricing. The discriminatory pricing the chain stores were able to obtain allowed them to unfairly crush their independent rivals. These chain stores were antithetical to the Jeffersonian conception of open markets, which centered around locally owned businesses that created economic opportunities, provided many options for consumers to purchase goods, and recycled wealth into their communities. To correct the distortion of America’s political economy created by the chain stores, Congress enacted the RPA.

The RPA’s proscriptions are straightforward: Firms must offer equal prices for purchased or sold goods, and variations in pricing are restricted to those based on actual cost differences, such as cost variations related to transportation or manufacturing, as opposed to some arbitrary decision. Critically, this means that dominant buyers like Amazon or Walmart must receive substantially similar pricing as a mom-and-pop store. In other words, powerful firms like Amazon cannot be bullies and use their sheer corporate size or privileged access to capital to demand or obtain discriminatory prices and terms from their suppliers. As one member of Congress cogently stated during the legislative debates preceding its enactment, the RPA was meant to establish “equal opportunity and fair play which…guarantees the integrity and wholesomeness of local community life against corruption and impoverishment.”

Despite the RPA’s sensible restrictions, it has attracted more criticism than any other antitrust law. The RPA is the most despised antitrust law enacted by Congress. A cursory glance at the literature describing the RPA allows one to witness the breadth of disparagements available in the English language. The RPA is described variously as the “Typhoid Mary of antitrust, a “hodge-podge of confusion,” and “one of the most tortuous legislative pronouncements ever.”

The near-reflexive criticisms of the RPA reveal a desire to promote a narrow conception of “competition” that heavily favors coercion by dominant corporations unfairly wielding their financial and market might. Critics of the RPA would like to see the law fully repealed based on the belief that the law prevents ostensibly beneficial competition and increases prices for consumers. Indeed, the law itself has been repeatedly described as “anticompetitive.” These assertions are either incorrect or distressingly deceptive.

Instance after instance shows the need to restrict the conduct of powerful buyers through vigorous enforcement of the RPA and the deleterious effects of not doing so. None are more evident or notorious than the actions of Amazon and Walmart. Both leviathans are owned by some of the wealthiest individuals in human history and represent trillions in market capitalization and hundreds of billions in annual sales.

Concerning Walmart, at a 2017 conference held in their Arkansas headquarters, the company flatly demanded that suppliers like Unilever and Kraft Heinz reduce their costs by 15 percent. During this period as well, Walmart leveraged its buyer power by repeatedly heightening its on-time delivery requirements from its suppliers. Starting in 2017, Walmart demanded a 75 percent on-time delivery rate. By 2020, in the middle of the tumultuous COVID-19 pandemic, the mandatory rate rose to 98 percent.

In an effort to demonstrate its power, Walmart executives stated in a 2022 meeting that it would refuse to accept new price increases from suppliers. Indeed, historical accounts reveal that Walmart has routinely demanded that its suppliers reduce their costs by five percent annually. A 2005 book succinctly described Walmart as so enormous “it can (and does!) demand just about anything it wants from its vendors, from deeper-than-usual discounts to downright disadvantageous shipping policy to enforced returns on slow-moving merchandise.”

In regards to Amazon, journalist Brad Stone in 2004 detailed the company’s program to squeeze preferential prices from its most vulnerable dependents, which Amazon called the Gazelle Project—named to describe how a cheetah hunts and kills gazelles. In 2018, reports surfaced that Amazon was flagrantly demanding preferential pricing and terms from suppliers like Procter & Gamble to ensure its prices were the absolute lowest available on the internet.

Suppliers incapable of capitulating to Amazon’s or Walmart’s bullying comes with severe punishment, such as being thrown out as a supplier, arbitrarily being imposed penalties, or, in the case of Amazon, products being demoted in online search rankings. For suppliers dependent on Walmart or Amazon, the choice is to capitulate to their demands or be shut out of the market.

Rather than engage in socially beneficial competition, this kind of conduct by Walmart and Amazon is highly corrosive to our political economy. While the prices may be low on Amazon or Walmart, due to a phenomenon known as the “waterbed effect,” suppliers, seeking to make up for their lost margins by offering favorable terms to Amazon, are likely forced to raise their prices for other, less powerful firms. This circumstance creates a snowball effect where because Amazon has the lowest prices, consumers are dissuaded from shopping elsewhere and then shift even more of their buying to Amazon, which entrenches the company’s dominant market position further, giving it even more clout to demand privileged pricing and higher prices for everyone else. Amazon then can kill off its competitors by wielding its sheer size and access to preferential terms.

As revealed in the landmark 1934 report by the Federal Trade Commission that led to the enactment of the RPA, it was precisely this kind of conduct that allowed the chain stores of the 1930s to crush their independent rivals and monopolize local markets. Other consequences of allowing firms to exercise their buyer power at will has also led to lower wages for workers. This behavior also has bad effects for the consumer: By killing off smaller, less privileged competitors, consumers have reduced access and choice for products.

By proscribing buyer coercion and discriminatory pricing, instead of stifling competition entirely, the RPA shifts market competition. As opposed to allowing firms like Amazon or Walmart to wield their colossal size against their suppliers to obtain preferential terms, the corporations can lower their profit margins or operate more efficiently to obtain lower prices. Both corporations can buy products from suppliers in bigger volumes to obtain a lower per unit price—a practice the RPA encourages so long as the discounts are constructed equitably. Walmart can invest more to expand its transportation and delivery network to allow suppliers to charge the company lower prices due to real differences in cost. Amazon can engage in additional internal expansion of its operations by hiring more workers and building its own manufacturing infrastructure to produce its own products in-house. Both companies can focus more of their resources on improving the quality of their products or becoming more attractive workplaces to obtain the best industry talent.

By encouraging a firm to allocate more of its resources into expanding its productive capacity or providing more product choice for consumers or more jobs for workers, the restrictions imposed by the RPA, while inhibiting one method of competition, promote using others that benefit the public. It also facilitates investment by firms and leverages genuine economic efficiencies while curtailing a dominant firm’s predatory tactics.

The RPA, while not a perfect law, is a sensible statute addressing a clear problem. In the words of the former FTC Commissioner Philip Elman, “Congress sought to assure that the prohibition of price discrimination would not prevent the development of efficient distribution methods or deprive buyers of the rewards of lower prices which are the incentives for seeking more efficient methods.”

Indeed, when it was once a keystone in America’s competition law regime between the 1940s and 1970s, the RPA assisted with channeling corporate conduct into precisely this kind of socially beneficial competition. During the height of its enforcement in the 1960s, when the FTC initiated over 500 actions, the RPA worked alongside other strict prohibitions from antitrust laws to structure the economy to ensure socially beneficial competition. For example, scholarly literature recounts how companies like DuPont, American Can, and IBM—some of the largest corporations of their era—all plowed significant financial resources into research and development after incurring repeated antitrust lawsuits.

Further, there is scant evidence that the RPA leads to higher consumer prices. However, in spite of the exceptionally limited number of empirical studies on the RPA, one study has actually shown that the RPA increases price competition. This result intuitively makes sense. If firms are receiving nearly identical prices for the goods they are purchasing, other channels of competition, such as lowering margins, increasing product quality, or offering additional marketing services become more viable and meaningful.

Moreover, regardless of the ephemeral potential of price increases, the drafters of the RPA explicitly stated that higher prices were worth it if they facilitated fairness in the economy and restrained undue corporate power. Representative Wright Patman stated that Congress designed his namesake bill to facilitate “low prices…consistent with good prices to the wage earner who converts that raw material into the finished product for retail distribution.” In other words, when Congress enacted the RPA, it consciously chose to ensure fair treatment, prices, and wages took primacy over low prices for their own sake.

Despite the existence of such violative conduct from firms like Walmart and Amazon, along with the potency of the RPA and its enforcement benefits, why has the federal government not initiated blockbuster lawsuits? The answer is that since the 1970s, the defense bar and libertarian Chicago School economists engaged in a highly successful campaign to systematically dismantle the antitrust laws by marketing a demonstrably false narrative and asserting they were designed to almost solely focus on low prices to consumers under the moniker of “consumer welfare.” One of their prime targets was the RPA. Liberals like Ralph Nader also took particular umbrage against RPA enforcement on the grounds that the law was complicated, provided “questionable value” to consumers, and, because it was being enforced too vigorously, symbolized organizational incompetence at the FTC. These simultaneous efforts set the stage for significant retrenchment of RPA enforcement.

After obtaining prominent enforcement positions in the federal government in the 1970s and publishing a widely circulated report, Chicago School sympathizers directed the DOJ to completely abandon enforcement of the RPA. As with the DOJ, enforcement from the FTC precipitously dropped in the 1970s, with the last lawsuit from the agency during the Clinton administration. A scathing 1972 report published by Ralph Nader and his “raiders” also asserted that the RPA should be repealed unless enforcement was substantially curtailed.

Since the 1970s as well, the Chicago School has successfully convinced the Supreme Court to weaken the RPA and the antitrust laws more generally by restricting its application and imposing substantial legal burdens on private plaintiffs, making litigation significantly harder and more expensive. Moreover, organizations like the Chamber of Commerce, which effectively serve as mouthpieces for the defense bar, also continue to peddle highly distorted narratives about the RPA in all likelihood to maintain the status quo and thwart any potential action by the administration as they know that without the firepower of the federal government, RPA claims against companies like Amazon and Walmart are unlikely to prevail.

Subscribe Today

Get daily emails in your inbox

The wholesale abandonment of RPA enforcement from the federal government by such a miscarriage of prosecutorial discretion is fundamentally at odds with Congress’s intent and the rule of law. Nevertheless, Congress has not repealed the RPA, and historical attempts at such action have been repeatedly rejected. In other words, the RPA is merely in a dormant state, and thus ready and capable of being revived and vigorously enforced.

The Biden administration has already taken several steps to restore the RPA, including initiating two FTC investigations, issuing a short guidance document, and giving speeches detailing the RPA’s goals. Based on these recent actions from Biden administration officials, there is clearly an overwhelming eagerness to initiate an enforcement action. Marketplace bullies like Amazon and Walmart should be on notice that their unfair practices could soon face heavy condemnation. Such a lawsuit cannot come soon enough and should be openly welcomed.

This article is part of the “American System” series edited by David A. Cowan and supported by the Common Good Economics Grant Program. The contents of this publication are solely the responsibility of the authors.