Raising American Wages…by Raising American Wages

With Americans still trapped in the fifth year of our Great Recession, and median personal income having been essentially stagnant for forty years, perhaps we should finally admit that decades of economic policies have largely failed.

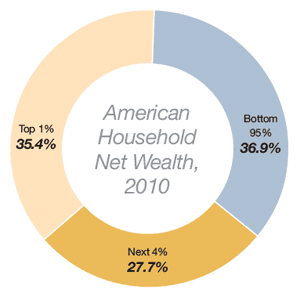

The last two years of our supposed recovery have seen American growth rates averaging well under 2 percent.[i] Although our media often pays greater attention to the recent gains in stock market and asset prices, such paltry growth means that many of the millions of jobs lost in 2008 and 2009 will never be regained, and the broadest measures of American unemployment and underemployment will remain stuck in the vicinity of 15%.[ii] Meanwhile, an astonishing 93% of the total increase in income during the recovery period has been captured by the top one percent of earners, who now hold almost as much net wealth as the bottom 95 percent of our society.[iii] This polarized situation does not bode well for our future, and unless broader social trends in jobs and incomes soon improve, dark days surely lie ahead.

The last two years of our supposed recovery have seen American growth rates averaging well under 2 percent.[i] Although our media often pays greater attention to the recent gains in stock market and asset prices, such paltry growth means that many of the millions of jobs lost in 2008 and 2009 will never be regained, and the broadest measures of American unemployment and underemployment will remain stuck in the vicinity of 15%.[ii] Meanwhile, an astonishing 93% of the total increase in income during the recovery period has been captured by the top one percent of earners, who now hold almost as much net wealth as the bottom 95 percent of our society.[iii] This polarized situation does not bode well for our future, and unless broader social trends in jobs and incomes soon improve, dark days surely lie ahead.

***

If we seek to create jobs and raise incomes for ordinary Americans, we should consider what sorts of jobs and incomes these might be. Since economists and policy analysts tend to have advanced degrees and many leading journalists these days are Ivy League alumni, their employment perceptions may often diverge from reality. So let us review the official government data from the Bureau of Labor Statistics (BLS), as discussed by Prof. Jack Metzgar of Chicago’s Center for Working-Class Studies and brought to my attention in an excellent column by the late Alexander Cockburn.[iv] Metzgar writes:

The BLS’s three largest occupational categories by themselves accounted for more than one-third of the workforce in 2010 (49 million jobs), and they will make an outsized contribution to the new jobs projected for 2020. They are:

Office and administrative support occupations (median wage of $30,710)

Sales and related occupations ($24,370)

Food preparation and serving occupations ($18,770)

Other occupations projected to provide the largest number of new jobs in the next decade include child care workers ($19,300), personal care aides ($19,640), home health aides ($20,560), janitors and cleaners ($22,210), teacher assistants ($23,220), non-construction laborers ($23,460), security guards ($23,920), and construction laborers ($29,280).

Although our bipartisan elites regularly suggest higher education as the best elixir for what ails our economy and its workers, few of these job categories seem logical careers for individuals who have devoted four years of their life to the study of History, Psychology, or Business Education, often at considerable expense. Nor would we expect the increased production of such degrees, presumably at lower-tier or for-profit colleges, to have much positive impact on the wages or working conditions of janitors or security guards.

Consider that only 20% of current jobs require even a bachelors’ degree.[v]More than 30% of Americans over the age of 25 have graduated college, so this implies that one-third or more of today’s college graduates are over-educated for their current employment, perhaps conforming to the stereotype of the college psychology major working at Starbucks or McDonalds.

Furthermore, this employment situation will change only gradually over the next decade, according to BLS projections. Millions of jobs in our “knowledge economy” do currently require a post-graduate degree, and the numbers are growing rapidly; but even by 2020, these will constitute less than 5% of the total, while around 70% of all jobs will still require merely a high school diploma.[vi]

Education may be valuable for other reasons, but it does not seem to hold the answer to our jobs and incomes problem.

If additional education is a dead end, other partisan nostrums appear equally doubtful. Large cuts in government taxation or regulation are unlikely to benefit the average sales clerk or waitress. And the favored progressive proposal of a huge new government stimulus package has absolutely no chance of getting through Congress; but even if it did, few of the funds would flow to the low-paid private sector service workers catalogued above, and any broader social gains would rely upon a secondary boost in economic activity produced by putting extra government dollars into private pockets.

So how might we possibly raise the wages of American workers who fill this huge roster of underpaid and lesser-skilled positions, holding jobs which are almost entirely concentrated in the private service sector?

***

Perhaps the most effective means of raising their wages is simply to raise their wages.

Consider the impact of a large increase in the federal minimum wage, perhaps to $10 or more likely $12 per hour.

The generally low-end jobs catalogued above are entirely in the non-tradable service sector; they could not be outsourced to even lower-paid foreigners in Bangalore or Manila. Perhaps there might be some incentive for further automation, but the nature of the jobs in question – focused on personal interactions requiring human skills – are exactly those least open to mechanical replacement. Just consider the difficulty and expense of automating the job of a home health care aide, child care worker, or bartender.

With direct replacement via outsourcing or automation unlikely, employers responding to a higher minimum wage would be faced with the choice of either increasing the wages of their lowest paid workers by perhaps a couple of dollars per hour, or eliminating their jobs. There would likely be some job loss,[vii] but given the simultaneous rise in labor costs among all competitors and the localized market for these services, the logical business response would be to raise prices by a few percent to help cover increased costs while also trimming current profit margins. Perhaps consumers would pay 3 percent more for Wal-Mart goods or an extra dime for a McDonald’s hamburger, but most of the jobs would still exist and the price changes would be small compared to typical fluctuations due to commodity and energy prices, international exchange rates, or Chinese production costs.

The resulting one-time inflationary spike would slightly raise living expenses for everyone in our society, but the immediate 20% or 30% boost in the take-home pay of many millions of America’s lowest income workers would make it easy for them to absorb these small costs, while the impact upon the middle or upper classes would be totally negligible. An increase in the hourly minimum wage from the current federal level of $7.25 to (say) $12.00 might also have secondary, smaller ripple effects, boosting wages currently above that level as well.

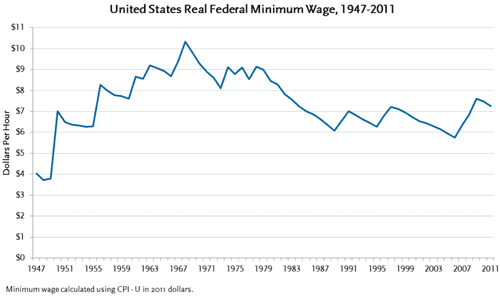

A minimum wage in this range is hardly absurd or extreme. In 2012 dollars, the American minimum wage was over $10 in 1968 during our peak of postwar prosperity and full employment.[viii] The average minimum wage in Canadian provinces is currently well over $10 per hour, the national figure for France is more than $12, and Australia has the remarkable combination of a minimum wage of nearly $16.50 together with 5 percent unemployment.[ix]

Even a large increase in the minimum wage would have very little impact on America’s international competitiveness since almost everyone employed in our surviving manufacturing export sector – whether in unionized Seattle or non-union South Carolina – already earns far above the current minimum wage. The same is also true for government workers, resulting in negligible increased cost to taxpayers.

Leaving aside the obvious gains in financial and personal well-being for the lower strata of America’s working class, there would also be a large economic multiplier effect, boosting general business activity in our weak economy. America’s working poor tend to spend almost every dollar they earn, often even sinking into temporary debt on a monthly basis.[x] Raising the annual income of each such wage-earner couple by eight or ten thousand dollars would immediately send those same dollars flowing into the regular consumer economy, boosting sales and general economic activity. In effect, the proposal represents an enormous government stimulus package, but one targeting the working-poor and funded entirely by the private sector.

Ironically, it is likely that major elements of the private sector would be perfectly happy with this arrangement. For example, despite their low-wage and anti-worker reputation, Wal-Mart’s top executives lobbied Congress in 2005 for an increase in the minimum wage, concerned that their working-class customer base was growing too impoverished to shop at their stores.[xi] Wal-Mart might never be willing to raise its wages in isolation, but if a higher minimum wage forces all competitors to do the same, then prices can also be raised to help make up the difference, while the large rise in disposable consumer income would greatly increase sales.

***

Although the direct financial benefits to working-class Americans and our economy as a whole are the primary justifications for the proposal, there are a number of subsidiary benefits as well, ranging across both economic and non-economic areas.

First, the net dollar transfers through the labor market in this proposal would generally be from higher to lower income strata, and lower-income individuals tend to pay a much larger fraction of their income in payroll and sales taxes. Thus, a large boost in working-class wages would obviously have a very positive impact on the financial health of Social Security, Medicare and other government programs funded directly from the paycheck. Meanwhile, increased sales tax collections would improve the dismal fiscal picture for state and local governments, and the public school systems they finance.

Furthermore, as large portions of the working-poor became much less poor, the payout of the existing Federal Earned Income Tax Credit (EITC) would be sharply reduced. Although popular among politicians, the EITC is a classic example of economic special interests privatizing profits while socializing costs: employers receive the full benefits of their low-wage workforce while a substantial fraction of the wage expense is pushed onto the taxpayers. Private companies should fund their own payrolls rather than rely upon substantial government subsidies, which produce major distortions in market signals.

Even on the highly contentious and seemingly unrelated issue of immigration, a large rise in the minimum wage might have a strongly positive impact. During the last decade or two, American immigration has been running at historically high levels, with the overwhelming majority of these immigrants being drawn here by hopes of employment.[xii] This vast influx of eager workers has naturally strengthened the position of Capital at the expense of Labor, and much of the stagnation or decline in working-class wages has probably been a result, since this sector has been in greatest direct competition with lower-skilled immigrants.[xiii]

Not only would a large rise in the minimum wage reverse many years of this economic “race to the bottom,” but it would impact immigration itself, even without changes in government enforcement policy. One of the few sectors likely to be devastated by a much higher minimum wage would be the sweatshops and other very low wage or marginal businesses which tend to disproportionably employ new immigrants, especially illegal ones. Sweatshops and similar industries have no legitimate place in a developed economy, and their elimination would reduce the sort of lowest-rung job openings continually drawing impoverished new immigrants. Meanwhile, those immigrants who have already been here some time, learned English, and established a solid employment record would be kept on at higher wages, reaping the same major benefits as non-immigrant Americans within the ranks of the working-poor.

***

Finally, one of the more unexpected benefits of a large rise in the minimum wage would follow from a total reversal of bipartisan conventional wisdom. Whereas our elites regularly tell us that an increase in higher education might have the benefit of raising American wages, I would instead argue that a sharp rise in ordinary wages would have the benefit of reducing higher education, whose growth increasingly resembles that of an unsustainable bubble.

Between 2000 and 2010, enrollment in postsecondary institutions increased 37 percent, compared to just 11 percent during the previous decade, with the recent increase being almost three times that of the growth of the underlying population of 18- to 24-year-olds. Indeed, relative enrollment growth for older students – 25 and above – was far greater than for students in the younger, more traditional ages. Furthermore, “Business” has overwhelmingly become the most popular undergraduate major, attracting nearly as many students as the combined total of the next three categories – Social Sciences and History, Health Sciences, and Education.[xiv]

If rapidly growing numbers of individuals, especially those many years past their high school graduation, are now attending college and majoring in Business, they are probably not doing so purely out of love of learning and a desire for broadening their intellectual horizons. Instead, they have presumably accepted the pronouncements of authority figures that higher education will benefit them economically. Put in harsher terms, they may believe that a college degree is their best hope of avoiding a life of permanent poverty trapped in the ranks of the working-poor.

Although there is a clear mismatch between the requirements of America’s projected jobs and the benefits of a college education, this notion of “college or poverty” may not be entirely mistaken. A recent college graduate is almost 20 percentage points more likely to have a job than a person of the same age with only a high school degree.[xv] As a competitive signaling device, a 4-year degree may help someone land an office job as an administrative assistant rather than one as a fast-food server. But this is costly to the individual and to society.

Even leaving aside the absurdity of young people spending years of their lives studying business theory or psychology to obtain jobs which traditionally went to high school graduates, the financial cost is enormous. A generation or more ago, expenses at solid state institutions and similar colleges were fairly low, and could mostly be financed by small grants, parental savings, and part-time student jobs. But educational costs have increased 133% above inflation over the last thirty years,[xvi] and the government-subsidized college-loan industry has grown in parallel. Last year, the total volume of outstanding student-loan debt passed the trillion dollar mark, now exceeding either credit-card or auto loan debt.[xvii]

Two-thirds of recent college graduates borrowed to finance their education, and their average debt is over $23,000, while the load for those who pursue graduate or professional degrees can easily exceed the hundred thousand dollar mark.[xviii] These debts are exempt from bankruptcy discharge, and unless graduates quickly find high-paying jobs – not easy in an economy with very high youthful unemployment – the required payments may remain larger than the combined total of their federal, state, and local taxes. This privatized “education tax” may become a permanent, terrible burden, pushing any plans for marriage, family, and home purchase into the distant future. Barely half of 18- to 24-year-olds are currently employed, the lowest level in over sixty years,[xix] so we should not be surprised that a quarter of all student-loan payers are currently delinquent.[xx] Without the possibility of bankruptcy to clear their load, permanent debt-peonage for a substantial fraction of the next generation seems a very real possibility.

The aggressive marketing tactics of for-profit colleges and the student loan industry have disturbing parallels with the sub-prime lenders who played a destructive role in the Housing Bubble. Our national elites gave strong public support to the goal of universal home-ownership. Families were warned that if they did not stretch their income and their credit to buy a house at the inflated prices being offered, they would be permanently priced out of the market and condemned to second-class economic citizenship. Today, very similar warnings are made about the failure to invest in a college education, and this is backed by the aggressive advertising and sales tactics of the lucrative and well-connected for-profit sectors of the Higher Education-Industrial Complex, such as University of Phoenix and Kaplan Schools.

The lax lending standards and regulatory policies supporting greater homeownership were a major factor in our catastrophic financial collapse, in which the average family has now lost 40% of its net worth and many millions of Americans are on the edge of foreclosure, bankruptcy, and destitution.[xxi] Nearly everyone lost, while a tiny handful of individuals and companies made vast, unearned fortunes from facilitating the growth of the bubble or later betting upon its collapse. A similar outcome in higher education seems quite likely.

Now consider the impact of a sharp rise in the minimum wage, sufficient to remove the taint of poverty overhanging so many of our lower-tier jobs. Those academically-oriented students who plan to pursue challenging college majors in engineering, computer software, or other STEM fields would be completely unaffected by a rise in pay for home health aides, nor would there be any impact on the college plans of those seeking to broaden their horizons with serious academic study in literature, history, or philosophy.

But for those millions who regard postsecondary education as merely a way of punching their ticket with a “business” degree and thereby gaining a shot at a middle class income, the calculus would be different: four years of academic work, four years of foregone income, and many tens of thousands of dollars in tuition and fees would be weighed against earning a reasonable living straight out of high school or with a form of shorter vocational training like an apprenticeship. Certainly in the past, when well-paid factory jobs were plentiful, a large fraction of students made the latter choice, and seldom regretted it.

Meanwhile, if college enrollments were reduced to those who actually wanted or needed a college education, supply and demand would begin deflating our Higher Education Bubble, forcing a sharp drop in ever-escalating educational costs. Since government loans and subsidies would be targeted at a much smaller pool of students, they could be made more generous, reducing the debt burden on those who do still seek a degree.

***

Public policy experts sometimes glorify complexity, proposing intricate, interlocking systems aimed at a desired result. But such structures are only as strong as their weakest link, and a proposal too complex to fully understand is also too complex to fix. Our government has sought to ensure a decent living for American workers through an enormous array of income subsidies, public benefits, training programs, and educational loans; at this point, many of these components have accumulated powerful and parasitic side-beneficiaries while leaving the working class behind.

Since this vast and leaky conglomeration has failed at its intended goal, perhaps we should just try raising wages instead.

(Originally published November 15, 2012 by The New America Foundation – PDF)