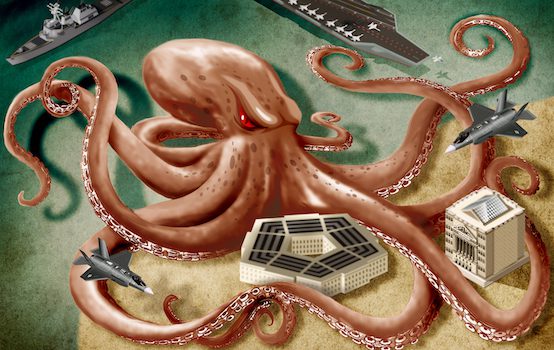

America’s Monopoly Crisis Hits the Military

Early this year, U.S. authorities filed criminal charges—including bank fraud, obstruction of justice, and theft of technology—against the largest maker of telecommunications equipment in the world, a Chinese giant named Huawei. Chinese dominance in telecom equipment has created a crisis among Western espionage agencies, who, fearful of Chinese spying, are attempting to prevent the spread of Huawei equipment worldwide, especially in the critical 5G next-generation mobile networking space.

In response to the campaign to block the purchase of Huawei equipment, the company has engaged in a public relations offensive. The company’s CEO, Ren Zhengfei, portrayed Western fears as an advertisement for its products, which are, he said, “so good that the U.S. government is scared.” There’s little question the Chinese government is interested in using equipment to spy. What is surprising is Zhengfei is right about the products. Huawei, a relatively new company in the telecom equipment space, has amassed top market share because its equipment—espionage vulnerabilities aside—is the best value on the market.

In historical terms, this is a shocking turnaround. Americans invented the telephone business and until recently dominated production and research. But in the last 20 years, every single American producer of key telecommunication equipment sectors is gone. Today, only two European makers—Ericsson and Nokia—are left to compete with Huawei and another Chinese competitor, ZTE.

This story of lost American leadership and production is not unique. In fact, the destruction of America’s once vibrant military and commercial industrial capacity in many sectors has become the single biggest unacknowledged threat to our national security. Because of public policies focused on finance instead of production, the United States increasingly cannot produce or maintain vital systems upon which our economy, our military, and our allies rely. Huawei is just a particularly prominent example.

When national security specialists consider preparedness, they usually think in terms of the amount of money spent on the Pentagon. One of President Donald Trump’s key campaign promises was to aggressively raise the military budget, which he, along with Congress, started doing in 2017. The reaction was instant. “I’m heartened that Congress recognizes the sobering effect of budgetary uncertainty on America’s military and on the men and women who provide for our nation’s defense,” then-defense secretary Jim Mattis said. Budgets have gone up every year since.

Higher budgets would seem to make sense. According to the 2018 National Defense Strategy, the United States is shifting away from armed conflicts in the Middle East to “great power” competition with China and Russia, which have technological parity in many areas with the United States. As part of his case for higher budgets, Mattis told Congress that “our military remains capable, but our competitive edge has eroded in every domain of warfare—air, land, sea, space, and cyber.”

In some cases, our competitive edge has not just been eroded, but is at risk of being—or already is—surpassed. The Chinese surge in 5G telecom equipment, which has dual civilian and military uses, is one example. China is making key investments in artificial intelligence, another area of competition. They even seem to be able to mount a rail gun on a naval ship, an important next generation weapons technology that the U.S. Navy has yet to incorporate.

And yet, the U.S. military budget, even at stalled levels, is still larger than the next nine countries’ budgets combined. So there’s a second natural follow-up question: is the defense budget the primary reason our military advantage is slipping away, or is it something deeper?

The story of Huawei, and many others, suggests the latter.

♦♦♦

For over a century, America led the world in producing telecommunications equipment. The American telecom industry, according to Zach Mottl of Atlas Tool Works, a subcontractor in the industry, used to be a “crown jewel of American manufacturing.” Mottl’s company had been a manufacturing supplier to AT&T and its Bell Labs from the early 1900s until the early 2000s. “The radar system was invented here. The transistor came out of Bell Labs. The laser. I mean all of these high-tech inventions that have both commercial and military applications were funded out of the research,” Mottl told TAC. More than just the sexy inventions, there was a domestic industrial sector which could make the equipment. Now, in a strategic coup for our adversaries, that capability is gone.

Yet it wasn’t one of those adversaries that killed our telecommunications capacity, but one of our own institutions, Wall Street, and its pressure on executives to make decisions designed to impress financial markets, rather than for the long-term health of their companies. In 1996, AT&T spun off Bell Labs into a telecom equipment company, Lucent Technologies, to take advantage of investors’ appetite for an independent player selling high-tech telecom gear after Congress deregulated the telecommuncations space. At the time, it was the biggest initial public offering in history, and became the foundation of a relationship with financial markets that led to its eventual collapse.

The focus on stock price at Lucent was systematic. The stock price was posted daily to encourage everyone to focus on the company’s relationship with short-term oriented financial markets. All employees got a small number of “Founder’s Grant Share Options,” with executives offered much larger slugs of stock to solidify the connection. When Richard McGinn became CEO in 1997, he focused on financial markets.

Lucent began to buy up companies. According to two scholars, “The perceived need to compete for acquisitions became a ‘strategic’ justification for keeping stock prices high. This in turn demanded meeting or exceeding quarterly revenue and earnings targets, objectives with which Lucent top executives, led by the hard-driving McGinn, became obsessed.”

Lucent got even more aggressive. McGinn’s subordinate, an executive named Carly Fiorina, juiced returns with a strategy based on lending money to risky startups who would then turn around and buy Lucent equipment. Fiorina collected $65 million in compensation as the stock soared. And then, when the dot-com boom turned to bust, the company, beset by accounting scandals designed to impress shareholders and the financial markets, embarked on massive layoffs. CEO McGinn was among those laid off, but with a $12.5 million severance package—royal compensation for taking one of America’s strategic industrial assets down the road toward total destruction.

In the early 2000s, the telecom equipment market began to recover from the recession. Lucent’s new strategy, as Mottl put it, was to seek “margin” by offshoring production to China, continuing layoffs of American workers and hiring abroad. At first, it was the simpler parts of the telecom equipment, the boxes and assembly, but soon contract manufacturers in China were making virtually all of it. American telecom capacity would never return.

Lucent didn’t recover its former position. Chinese entrants, subsidized heavily by the Chinese state and using Western technology, underpriced Western companies. American policymakers, unconcerned with industrial capacity, allowed Chinese companies to capture market share despite the predatory subsidies and stolen technology. In 2006, French telecom equipment maker Alcatel bought Lucent, signifying the end of American control of Bell Labs. Today, Huawei, with state backing, dominates the market.

The erosion of much of the American industrial and defense industrial base proceeded like Lucent. First, in the 1980s and 1990s, Wall Street financiers focused on short-term profits, market power, and executive pay-outs over core competencies like research and production, often rolling an industry up into a monopoly producer. Then, in the 2000s, they offshored production to the lowest cost producer. This finance-centric approach opened the door to the Chinese government’s ability to strategically pick off industrial capacity by subsidizing its producers. Hand over cash to Wall Street, and China could get the American crown jewels.

The loss of manufacturing capacity has been devastating for American research capacity. “Innovation doesn’t just hover above the Great Plains,” Mottl said. “It is built on steady incremental changes and knowledge learned out of basic manufacturing.” Telecommunications equipment is dual use, meaning it can be used for both commercial and military purposes. The loss of an industrial base in telecom equipment meant that the American national security apparatus lost military capacity.

This loss goes well beyond telecom equipment. Talking to small manufacturers and distributors who operate in the guts of our industrial systems offers a perspective on the danger of this process of financial predation and offshoring. Bill Hickey, who headed his family’s metal distributor, processor, and fabricator, has been watching the collapse for decades. Hickey sells to “everyone who uses steel,” from truck, car, and agricultural equipment manufacturers to stadiums and the military.

Hickey, like many manufacturers, has watched the rise of China with alarm for decades. “Everyone’s upset about the China 2025 plan,” he told TAC, referencing the current Chinese plan causing alarm among national security thinkers in Washington. “Well there was a China 2020 plan, 2016 plan, 2012 plan.” The United States has, for instance, lost much of its fasteners and casting industries, which are key inputs to virtually every industrial product. It has lost much of its capacity in grain oriented flat-rolled electrical steel, a specialized metal required for highly efficient electrical motors. Aluminum that goes into American aircraft carriers now often comes from China.

Hickey told a story of how the United States is even losing its submarine fleet. He had a conversation with an admiral in charge of the U.S. sub fleet at the commissioning of the USS Illinois, a Virginia-class attack submarine, who complained that the United States was retiring three worn-out boats a year, but could only build one and a half in that time. The Trump military budget has boosted funding to build two a year, but the United States no longer has the capacity to do high quality castings to build any more than that. The supply chain that could support such surge production should be in the commercial world, but it has been offshored to China. “You can’t run a really high-end casting business on making three submarines a year,” Hickey said. “You just can’t do it.” This shift happened because Wall Street, or “the LBO (leveraged buy-out) guys” as Hickey put it, bought up manufacturing facilities in the 1990s and moved them to China.

“The middle-class Americans who did the manufacturing work, all that capability, machine tools, knowledge, it just became worthless, driven by the stock price,” he said. “The national ability to produce is a national treasure. If you can’t produce you won’t consume, and you can’t defend yourself.”

The Loss of the Defense Industrial Base

But it’s not just the dual-use commercial manufacturing base that is collapsing. Our policy empowering Wall Street and offshoring has also damaged the more specialized defense base, which directly produces weaponry and equipment for the military.

How pervasive is the loss of such capacity? In September 2018, the Department of Defense released findings of its analysis into its supply chain. The results highlighted how fragile our ability to supply our own military has become.

The report listed dozens of militarily significant items and inputs with only one or two domestic producers, or even none at all. Many production facilities are owned by companies that are financially vulnerable and at high risk of being shut down. Some of the risk comes from limited production capability. Mortar tubes, for example, are made on just one production line, and some Marine aircraft parts are made by just one company—one which recently filed for bankruptcy.

At risk is everything from chaff to flares to high voltage cable, fittings for ships, valves, key inputs for satellites and missiles, and even material for tents. As Americans no longer work in key industrial fields, the engineering and production skills evaporate as the legacy workforce retires.

Even more unsettling is the reliance on foreign, and often adversarial, manufacturing and supplies. The report found that “China is the single or sole supplier for a number of specialty chemicals used in munitions and missiles…. A sudden and catastrophic loss of supply would disrupt DoD missile, satellite, space launch, and other defense manufacturing programs. In many cases, there are no substitutes readily available.” Other examples of foreign reliance included circuit boards, night vision systems, batteries, and space sensors.

The story here is similar. When Wall Street targeted the commercial industrial base in the 1990s, the same financial trends shifted the defense industry. Well before any of the more recent conflicts, financial pressure led to a change in focus for many in the defense industry—from technological engineering to balance sheet engineering. The result is that some of the biggest names in the industry have never created any defense product. Instead of innovating new technology to support our national security, they innovate new ways of creating monopolies to take advantage of it.

A good example is a company called TransDigm. While TransDigm presents itself as a designer and producer of aerospace products, it can more accurately be described as a designer of monopolies. TransDigm began as a private equity firm, a type of investment business, in 1993. Its mission, per its earnings call, is to give “private equity-like returns” to shareholders, returns that are much higher than the stock market or other standard investment vehicles.

It achieves these returns for its shareholders by buying up companies that are sole or single-source suppliers of obscure airplane parts that the government needs, and then increasing prices by as much as eight times the original amount. If the government balks at paying, TransDigm has no qualms daring the military to risk its mission and its crew by not buying the parts. The military, held hostage, often pays the ransom. TransDigm’s gross profit margins using this model to gouge the U.S. government are a robust 54.5 percent. To put that into perspective, Boeing and Lockheed’s profit margins are listed at 13.6 percent and 10.91 percent. In many ways, TransDigm is like the pharmaceutical company run by Martin Shkreli, which bought rare treatments and then price gouged those who could not do without the product. Earlier this year, TransDigm recently bought the remaining supplier of chaff and one of two suppliers of flares, products identified in the Defense Department’s supply chain fragility report.

TransDigm was caught manipulating the parts market by the Department of Defense Inspector General in 2006, again in 2008, and finally again this year. It is currently facing yet another investigation by the Government Accountability Office.

Yet, Trandigm’s stock price thrives because Wall Street loves monopolies, regardless of who they are taking advantage of. Take this analysis from TheStreet from March 2019, published after the latest Inspector General report and directly citing many of the concerning facts from the report as pure positives for the investor:

The company is now the sole supplier for 80% of the end markets it serves. And 90% of the items in the supply chain are proprietary to TransDigm. In other words, the company is operating a monopoly for parts needed to operate aircraft that will typically be in service for 30 years…. Managers are uniquely motivated to increase shareholder value and they have an enviable record, with shares up 2,503% since 2009.

Fleecing the Defense Department is big business. Its executive chairman W. Nicholas Howley, skewered by Democrats and Republicans alike in a May 2019 House Oversight hearing for making up to 4,000 percent excess profit on some parts and stealing from the American taxpayer, received total compensation of over $64 million in 2013, the fifth most among all CEOs, and over $13 million in 2018, making him one of the most highly compensated CEOs no one has ever heard of. Shortly after May’s hearing, the company agreed to voluntarily return $16 million in overcharges to the Pentagon, but the share price is at near record highs.

L3 Technologies, created in 1997, has taken a different, but also damaging, approach to monopolizing Defense Department contracts. Originally, it sought to become “the Home Depot of the defense industry” by going on an acquisition binge, according to its former CEO Frank Lanza. Today, L3 uses its size, its connections within the government, and its willingness to offer federal employees good-paying jobs at L3, to muscle out competitors and win contracts, even if the competitor has more innovative and better priced products. This practice attracted the ire of two Republican congressmen from North Carolina, Ted Budd and the late Walter Jones, who found in 2017 that L3 succeeds, in part, due to “blatant corruption and obvious disregard of American foreign interest in the name of personal economic profit.”

Like TransDigm, this isn’t L3’s first brush with trouble. It was temporarily suspended from U.S. government contracting for using “extremely sensitive and classified information” from a government system to help its international business interests. It was the subject of a scathing Senate Armed Services Committee investigation for failing to notify the Defense Department that it supplied faulty Chinese counterfeit parts for some of its aircraft displays. And it agreed to pay a $25.6 million settlement to the U.S. government for knowingly providing defective weapon sights for years to soldiers serving in Iraq and Afghanistan.

Yet, also like TransDigm, L3 has thrived despite its troubles. When the company was granted an open-ended contract to update the Air Force’s electronics jamming airplane in 2017, Lieutenant General Arnold Bunch outlined the Air Force’s logic at a House Armed Services Subcommittee meeting. L3, he said, is the only company that can do the job. “They have all the tooling, they have all the existing knowledge, and they have the modeling and all the information to do that work,” he said.

In other words, because L3 has a monopoly, there was no one else to pick. The system—a system designed by the financial industry that rewards monopoly and consolidation at the expense of innovation and national security—essentially made the pick for him. It is no wonder our military capacities are ebbing, despite the large budget outlays—the money isn’t going to defense.

♦♦♦

In fact, in some ways, our own defense budgets are being used against us when potential adversaries use Wall Street to take control of our own Pentagon-developed technologies.

There’s no better example than China’s takeover of the rare earth metal industry, which is key to both defense and electronics. The issue has frequently made the front page during the recent trade war, but the seldom-discussed background to our dependence on China for rare earths is that, just like with telecom equipment, the United States used to be the world leader in the industry until the financial sector shipped the whole thing to China.

In the 1970s and 1980s, the Defense Department invested in the development of a technology to use what are known as rare-earth magnets. The investment was so successful that General Motors engineers, using Pentagon grants, succeeded in creating a rare earth magnet that is now essential for nearly every high-tech piece of military equipment in the U.S. inventory, from smart bombs and fighter jets to lasers and communications devices. The benefit of DARPA’s investment wasn’t restricted to the military. The magnets make cell phones and modern commercial electronics possible.

China recognized the value of these magnets early on. Chinese Premier Deng Xiaoping famously said in 1992 that “The Middle East has oil, China has rare earth,” to underscore the importance of a rare earth strategy he adopted for China. Part of that strategy was to take control of the industry by manipulating the motivations of Wall Street.

Two of Xiaoping’s sons-in-law approached investment banker Archibald Cox, Jr. in the mid-1990s to use his hedge fund as a front for their companies to buy the U.S. rare-earth magnet enterprise. They were successful, purchasing and then moving the factory, the Indiana jobs, the patents, and the expertise to China. This was not the only big move, as Cox later moved into a $12 million luxury New York residence. The result is remarkably similar to Huawei: the United States has entirely divested of a technology and market it created and dominated just 30 years ago. China has a near-complete monopoly on rare earth elements, and the U.S. military, according to U.S. government studies, is now 100 percent reliant upon China for the resources to produce its advanced weapon systems.

Wall Street’s outsized control over defense contracting and industry means that every place a foreign adversary can insert itself into American financial institutions, it can insert itself into our defense industry.

At an Armed Services Committee hearing in 2018, Representative Carol Shea-Porter talked about how constant the conflict between financial concentration and patriotism had been in her six years on the committee. She recounted a CEO once telling her, in response to her concern about the outsourcing of defense industry parts, that he “[has] to answer to stockholders.”

Who are these stockholders that CEOs are so compelled to answer to? Oftentimes, China. Jennifer M. Harris, an expert in global markets with experience at the U.S. State Department and the U.S. National Intelligence Council, researched a recent explosion of Chinese strategic investment in American technology companies. She found that China has systematically targeted U.S. greenfield investments, “technology goods (especially semiconductors), R&D networks, and advanced manufacturing.”

The trend accelerated, until the recent flare-up of tensions between the United States and China. “China’s foreign direct investment (FDI) stock in the U.S. increased some 800% between 2009 and 2015,” she wrote. Then, from 2015 to 2017, “Chinese FDI in the U.S. …climbed nearly four-fold, reaching roughly $45.6 billion in 2016, up from just $12.8 billion in 2014.”

This investment runs right through Wall Street, the key lobbying group trying to ratchet down Trump’s tough negotiating posture with the Chinese. Rather than showing concern about the increasing influence of a foreign power in our commerce and industry, Wall Street banks have repeatedly followed Archie Cox down the path of easy returns.

In 2016, J.P. Morgan Chase agreed to pay a $264 million bribery settlement to the U.S. government for creating a program, called “Sons and Daughters,” to gain access to Chinese money by selectively hiring the unqualified offspring of high-ranking Communist Party officials and other Chinese elites. Several other banks are under investigation for similar practices, including Citigroup and Goldman Sachs, who, not coincidentally, hired the son of China’s commerce minister. It appears to have worked out for them. In 2017, Goldman Sachs partnered with the Chinese government’s sovereign wealth fund to invest $5 billion Chinese government dollars in American industry.

In short, China is becoming a significant shareholder in U.S. industries, and is selectively targeting those with strategic implications. Congresswoman Shea-Porter’s discovery that defense industry CEOs aren’t able to worry about national security because they “[have] to answer to shareholders” was disturbing enough. But the fact that it potentially translates as CEOs not being able to worry about national security because they have to answer to the Chinese should elevate the issue to the top of our national security discussion. This nexus of China, Wall Street, and our defense industrial base may be the answer to why our military advantage is ebbing. Even when American ingenuity can thrive, too often the fruits go to the Chinese.

In short, the financial industry, with its emphasis on short-term profit and monopoly, and its willingness to ignore national security for profit, has warped our very ability to defend ourselves.

How Did We Get Here?

Believe it or not, America has been here before. In the 1920s and 1930s, the American defense industrial base was being similarly manipulated by domestic financiers for their own purposes, retarding innovation and damaging the nation’s ability to defend itself. And American military readiness was ebbing in the midst of an increasingly dangerous world full of rising autocracies.

Today it might be artificial intelligence or drones, but in the 1930s the key military technology was the airplane. And as with much digital technology today, while Americans invented the airplane, many of the fruits went elsewhere. The reason was similar to the problem of Wall Street today. The American aerospace industry in the 1930s was undermined by fights among bankers over who got to profit from associated patent rights.

In 1935, Brigadier General William Mitchell told Congress that the United States didn’t have a single plane that could go against a “first-class power.” “It is a disgraceful situation and is due,” he said, “for one thing, to this pool of patents.” The lack of aerospace capacity reflected a broader industrial problem. Monopolists refused to invest in factories to produce enough steel, aluminum, and magnesium for adequate military readiness, for fear of losing control over prices.

New Dealers investigated, and by the time war broke out, the Roosevelt administration was in the midst of a sustained anti-monopoly campaign. The Nazi war machine, like China today, gave added impetus to the problem of monopoly in key technology-heavy industries. In 1941, an assistant attorney general for the antitrust division, Norman Littell, gave a speech to the Indiana State Bar Association about what he called “The German Invasion of American Business.”

The Nazis, he argued, used legal techniques, like patent laws, stock ownership, dummy corporations, and cartel arrangements, to extend their power into the United States. “The distinction between bombing a vital plant out of existence from an airplane and preventing that plant from coming into existence in the first place [through cartel arrangements],” he said, “is largely a difference in the amount of noise involved.”

Nazis used their American subsidiary corporations to spy on U.S. industrial capacity and steal technology, such as walkie-talkies, intertank and ground-air radio communication systems, and shortwave sets developed by the U.S. Army and Navy. They used patents or cartel arrangements to restrict the production of stainless steel, tungsten-carbide, and fuel injection equipment. According to the U.S. military after the war, I.G. Farben, the Nazi chemical monopoly, had influence over American production of “synthetic gas and oils, dyestuffs, explosives, synthetic rubber (‘Buna’), menthol, cellophane, and other products,” and sought to keep the United States “entirely dependent” on Germany for certain types of electrical equipment.

The Nazis took advantage of an industrial system that was, like the current one, organized along short-term objectives. But seeing the danger, New Dealers attacked the power of financiers through direct financing of factories, excess profits taxes, and the breaking of the power of the Rockefeller, Dupont, and Mellon empires through bank regulation and antitrust suits. They separated the makers of airplanes from airlines, a sort of Glass Steagall for aerospace. During the war itself, antitrust chief Thurman Arnold, and those he influenced, sought to end international cartels and loosen patent rules in part because they allowed control over American industry by the Nazis.

After the war, the link between global cartels and national security vulnerabilities was a key driver of American trade and military strategy. America pursued globalization, but with two differences from the form we have today. First, strategists sought to prevent the recurrence of global cartels and monopolies. Second, they sought to become industrially intertwined with allies, not rivals. While multinational corporations stretched across the West, they did not locate production or technology development in Moscow or among strategic rivals, as we do today in China.

Domestically, anti-profiteering institutions and rules protected against corruption, especially important when the defense budget comprised a large chunk of overall American research and development. The Defense Department’s procurement agency—the Defense Logistics Agency—was enormously powerful and oversaw procurement and supply challenges. The Pentagon had the power to force suppliers of sole source products—contractors that had monopolies—to reveal cost information to the government. The financial health of defense contractors mattered, but so did value to the taxpayer, a skilled defense industrial workforce, and the ability to deliver quality products to aid in national defense.

A fragmented base of contractors and subcontractors ensured redundancy and competition, and a powerful federal apparatus with thousands of employees with expertise in pricing and negotiation kept prices reasonable. The Defense Department could even take ownership of specialized tooling rights to create competition in monopolistic markets with specialized spare part needs—which is precisely where TransDigm specializes. This authority and expertise had been carefully cultivated over decades to provide the material necessary to equip American soldiers for World War II, the Korean and Vietnam wars, and the first Gulf war.

In the 1980s, while Ronald Reagan allowed Wall Street free rein elsewhere in the economy, he mostly kept Wall Street from going after the defense base. But scholars began debating whether it made sense to have such a large and expensive negotiating apparatus to deal with contractors, or if a more “cooperative” approach should be taken. Business consultants argued that the Pentagon could save money if it would simply be “a better customer, by being less adversarial and more trusting” of defense contractors.

With the end of the Cold War, these arguments found new resonance. Bill Clinton took the philosophical change that Reagan had pushed on the civilian economy, and moved it into the defense base. In 1993, Defense Department official William Perry gathered CEOs of top defense contractors and told them that they would have to merge into larger entities because of reduced Cold War spending. “Consolidate or evaporate,” he said at what became known as “The Last Supper” in military lore. Former secretary of the Navy John Lehman noted, “industry leaders took the warning to heart.” They reduced the number of prime contractors from 16 to six; subcontractor mergers quadrupled from 1990 to 1998. They also loosened rules on sole source—i.e. monopoly—contracts, and slashed the Defense Logistics Agency, resulting in thousands of employees with deep knowledge of defense contracting leaving the public sector.

Contractors increasingly dictated procurement rules. The Clinton administration approved laws changing procurement, which, as the Los Angeles Times put it, got rid of the government’s traditional goals of ensuring “fair competition and low prices.” They reversed what the New Dealers had done to insulate American military power from financiers.

The administration also pushed Congress to allow foreign imports into American weapons through waivers of the Buy America Act, and demanded procurement officers stop asking for cost data. Mass offshoring took place, and businesses could increase prices radically.

This environment attracted private-equity shops, and swaths of the defense industry shifted their focus from aerospace engineering to balance sheet engineering. From 1993 to 2000, despite dramatic declines in Cold War military spending and declines in the number of workers in the defense industrial base and within the military, defense stocks outperformed the S&P.

Today, the American defense establishment quietly finds itself in the same predicament it did in the 1930s. Despite spending large amounts of money on weapons systems, it often gets substandard equipment. It is dependent for key sources of supply on business arrangements with potentially hostile powers. The problem is so big, so toxic, and so difficult that few lawmakers even want to take it on. But the increasingly obvious danger of Chinese power means we can no longer ignore it.

The Fix

Fortunately, this is fixable. Huawei’s predatory pricing success has shown policymakers all over the world what happens when we don’t protect our vital industrial capacity. Last year, Congress strengthened the Committee on Foreign Investment in the United States, the committee that reviews foreign investment and mergers. The Trump tariffs have begun forcing a long-overdue conversation across the globe about Chinese steel and aluminum overcapacity, and Democrats like Representative Dan Lipinski are focused on reconstituting domestic manufacturing ability.

Within the defense base itself, every example—from TransDigm to L3 to Chinese infiltration of American business—has drawn the attention of members of Congress. Representatives Ted Budd and Paul Cook are Republicans and Representatives Jackie Speier and Ro Khanna are Democrats. They are not alone. Democratic Senator Elizabeth Warren and Representative Tim Ryan have joined Khanna’s demand for a TransDigm investigation.

Moreover, focus on production is bipartisan. One of the most ardent opponents of consolidation in the 1990s is current presidential candidate Bernie Sanders, who in 1996 passed an amendment to block Pentagon subsidies for defense mergers, or what he called “Payoffs for Layoffs.” On the other end of the spectrum, Trump has refocused national security and trade officials on the importance of domestic manufacturing.

Defense officials have also become acutely aware of the problem. In a 2015 briefing at the Pentagon, in response to questions about Lockheed’s acquisition of Sikorsky, then secretary of defense Ash Carter emphasized the importance of not having “excessive consolidation,” including so-called vertical integration, in the defense industry because it is “[not] good for the defense marketplace, and therefore, for the taxpayer and warfighter in the long run.” Carter’s acquisition chief, Frank Kendall, also noted the “significant policy concerns” posed by the “continuing march toward greater consolidation in the defense industry at the prime contractor level” and the effect it has on innovation.

American policymakers in the 1990s lost the ability to recognize the value of production capacity. Today, many of the problems highlighted here are still seen in isolation, perhaps as instances of corruption or reduced capacity. But the problems—diminished innovation, marginal quality, higher prices, less redundancy, dependence on overseas supply chains, a lack of defense industry competition, and reduced investment in research and development—are not independent. They are the result of the financialization of industry and of monopoly. It’s time for a new strategic posture, one that puts a premium not just on spending the right amount on military budgets, but also on ensuring that financial actors don’t capture what we do spend. We must begin once again to recognize that private industrial capacity is a vital national security asset that we can no longer allow Wall Street to pillage. By seeing the problem in its totality, we can attack the power of finance within the commercial and defense base and restore our national security capacity once again.

There are many levers we can use to reorder our national priorities. The Defense Department, along with its new higher budgets, should have more authority to promote competition, break up defense conglomerates, restrict excess defense contractor profits, empower contracting officers to get cost information, and block private equity takeovers of suppliers. Congress could reinstate the authority of the Defense Department to simply take ownership of specialized tooling rights to create competition in monopolistic markets with specialized spare part needs, a power it once had.

In the commercial sector, rebuilding the industrial base will require an aggressive national mobilization strategy. This means aggressive investment by government to rebuild manufacturing capacity, selective tariffs to protect against Chinese or foreign predation, regulation to stop financial predation by Wall Street, and anti-monopoly enforcement to block the exploitation of market power.

Policymakers must recognize that industrial capacity is a public good and short-term actors on Wall Street have become a serious national security vulnerability. While private businesses are essential to our common defense, the public sector must once again structure how we organize our national defense and protect our defense industrial base from predatory finance. For several decades, Wall Street has been organizing not just the financing of defense contractors, but the capabilities of our very defense posture. That experiment has been a failure. It is time to wake up, before it’s too late.

Matt Stoller is a fellow at the Open Markets Institute. His book, Goliath: The 100-Year War Between Monopoly Power and Democracy, is due out this fall from Simon & Schuster. Lucas Kunce spent 12 years in the United States Marine Corps, and is a veteran of the Iraq and Afghanistan wars. The views presented are those of the authors and do not necessarily represent the views of the Department of Defense or its components. This article was supported by the Ewing Marion Kauffman Foundation. The contents of this publication are solely the responsibility of the authors.