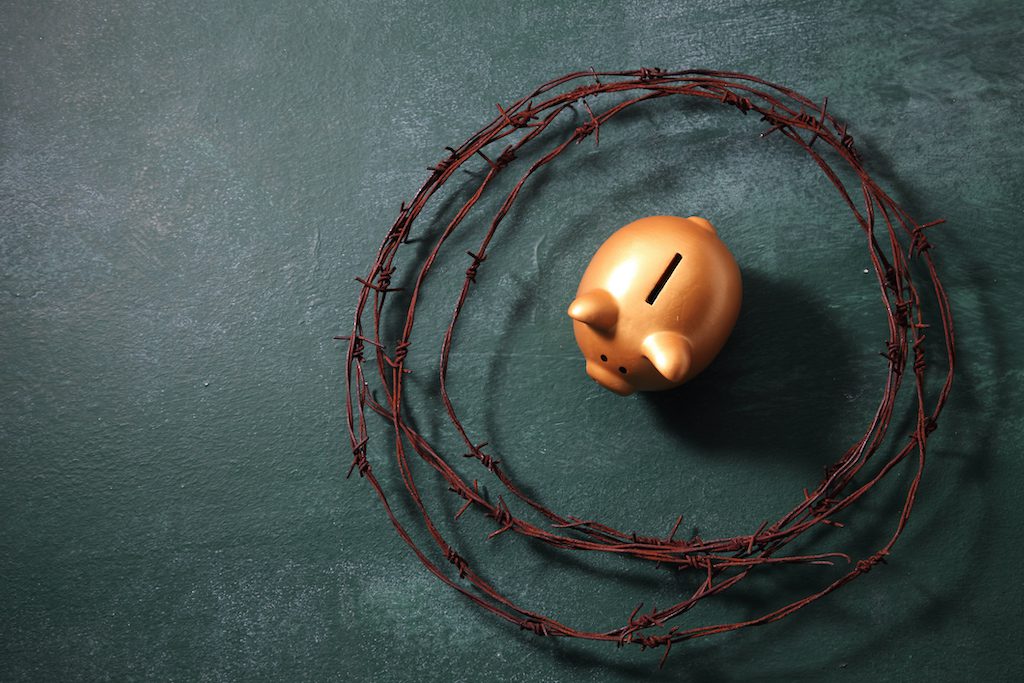

Woke Capitalism’s US Social Credit System

From Live Not By Lies, about how China uses its social credit system to compel conformity:

In theory, police don’t have to show up at the suspect’s door to make him pay for his disobedience. China’s social credit system automatically tracks the words and actions, online and off, of every Chinese citizen, and grants rewards or demerits based on obedience. A Chinese who does something socially positive—helping an elderly neighbor with a chore, or listening to a speech of leader Xi Jinping—receives points toward a higher social credit score. On the other hand, one who does something negative—letting his or her dog poop on the sidewalk, for example, or making a snarky comment on social media—suffers a social-credit downgrade.

Because digital life, including commercial transactions, is automatically monitored, Chinese with high social credit ratings gain privileges. Those with lower scores find daily life harder. They aren’t allowed to buy high speed train tickets or take flights. Doors close to certain restaurants. Their children may not be allowed to go to college. They may lose their job and have a difficult time finding a new one. And a social-credit scofflaw will find himself isolated, as the algorithmic system downgrades those who are connected to the offender.

The bottom line: a Chinese citizen cannot participate in the economy or society unless he has the mark of approval from Xi Jinping, the country’s all-powerful leader. In a cashless society, the state has the power to bankrupt dissidents instantly by cutting off access to the internet. And in a society in which everyone is connected digitally, the state can make anyone an instant pariah when the algorithm turns them radioactive, even to their family.

From a 2018 report in The Globe & Mail, here’s a real-life case of how it was used against a Chinese journalist who irritated the government by writing about corruption:

Liu Hu spent two decades pushing hard at the bounds of censorship in China. An accomplished journalist, he used a blog to accuse high-level officials of corruption and wrongdoing and to publish details of misconduct by authorities.

In late 2013, he was arrested and accused of “fabricating and spreading rumours.” Late in 2016, in a separate case, a court found him guilty of defamation and ordered him to apologize on his social-media account, which at the time had 740,000 followers. If he was unwilling to do that, the court said, he could pay verdict in an authorized news outlet. Mr. Liu paid the court $115, an amount he says he believed would cover publication costs.

Then, he said, the judge told him the entire verdict needed to be published, at a cost of at least $1,330.

But in the midst of Mr. Liu’s attempt to seek legal redress early in 2017, he discovered that his life had abruptly changed: Without any notice, he had been caught up in the early reaches of a social-credit system that China is developing as a pervasive new tool for social control – one expected to one day tighten the state’s grip on its citizens. Critics have called it an Orwellian creation – a new kind of “thought police.”

What it meant for Mr. Liu is that when he tried to buy a plane ticket, the booking system refused his purchase, saying he was “not qualified.” Other restrictions soon became apparent: He has been barred from buying property, taking out a loan or travelling on the country’s top-tier trains.

“There was no file, no police warrant, no official advance notification. They just cut me off from the things I was once entitled to,” he said. “What’s really scary is there’s nothing you can do about it. You can report to no one. You are stuck in the middle of nowhere.”

You cannot buy or sell unless you have the approval of the government. Notice this graf:

The development of social credit is also an attempt to regain the breadth of control the Communist Party once wielded over the country through work units and the state economy, before the rise of private enterprise eroded that power.

OK, but what would happen here in the West if private enterprise started imposing an informal social credit system on us? Gavin Haynes, writing for the UK commentary site UnHerd, says that it’s already happening to far-right people. He gives the example of white identitarians in the UK who were without warning refused service from their banks — including access to their money. There are other cases, including here in the US (e.g., Laura Loomer). Excerpt:

You don’t want to mess with the people who make the widgets that undergird the financial system. In 2018, in response to activist pressure, MasterCard began choking off various far-Right and internet Right figures. That in turn meant their often lucrative Patreon accounts were cancelled: YouTube ‘Classical Liberal’ Carl Benjamin lost $12000 a month. Now, in a post-Covid world, where we’re often being told that cash is no longer acceptable, some are also being told that electronic banking is no longer for them. It’s an interesting crossroads.

The likes of [far right activist Laura] Towler might be distasteful. But if that alone is the bar for the arbitrary exercise of power by, say, the PR department of NatWest, then all kinds of people — from Cat Bin Lady down — stand to be unpersoned.

Right of admission is always reserved — we all know this — and you might say that these examples are just the market at work. Except that some things are so fundamental to our everyday lives that they’re not so much markets as the thing that you need in order to use a market.

In the dying days of Gordon Brown, an attempt was made to guarantee every citizen’s right to a current account. It was quickly shot down by the Big Five banks (after all, it wasn’t as if they owed the government any favours). A decade on, that tide is further out than it has ever been.

We had all better pay attention to this. If you think that the banks and other gatekeepers of the financial system are going to stop with far-right political extremists, you are deluded. I mentioned here the other day that conservatives ought to be pushing legislators to fight wokeness with substantive policies and legislation. Here’s one: pass a law guaranteeing every citizen a right to a bank account. Everyone — even the bad people.

As Gavin Haynes observes, this is different from a private business having the right to withhold its trade from unsavory clients, in a particular way: having a bank account is required to participate in the economy in more than a primitive way. To deny someone that is to exile them from modern life. Moreover, the more our economies move to the cashless model, the more difficult it will be for those without a bank account (and a debit card that goes with it) to participate at all in the economy.

It cannot be left to the HR and PR departments of these banks and financial companies to decide who does and doesn’t have the right to participate in the economy, certainly not based on whether or not they hold political, religious, or cultural views that tick off decision-makers in those private entities. If lawmakers don’t use the power of the state to keep access to the economy open to individuals that the ruling class finds deplorable, then we should understand that we are well on our way to allowing Woke Capitalism to create an American social credit system.

And, as I contend in Live Not By Lies, people who can tell which way the wind is blowing need to start organizing now, building up resilient networks and practices while we have the freedom to do so.