The Myth of Wartime Prosperity

When pressed for a “success story” of their policies, Keynesians point with pride to World War II. They claim that it is the perfect illustration of the ability of massive government spending to lift an economy out of the doldrums.

In the effort to battle this myth, Steve Horwitz and Michael J. McPhillips offer an interesting new article that analyzes diaries, newspapers, and other primary source documents from the wartime era. They show that average Americans on the home front certainly did not think they were living amidst a great economic recovery. Yet as I’ll show in this article—relying on the pioneering efforts of Robert Higgs—we can use even the official statistics to turn the conventional Keynesian account on its head.

Before diving into the data, let me make a quick observation. I have heard many conservatives say, “FDR’s New Deal had nothing to do with fixing the economy. It was World War II that got us out of the Depression!” Yet when they say this, they give away the whole game. They are admitting that government spending can cure an economic downturn, and are just quibbling over whether it was FDR’s spending on schools and bridges, versus his spending on tanks and aircraft carriers.

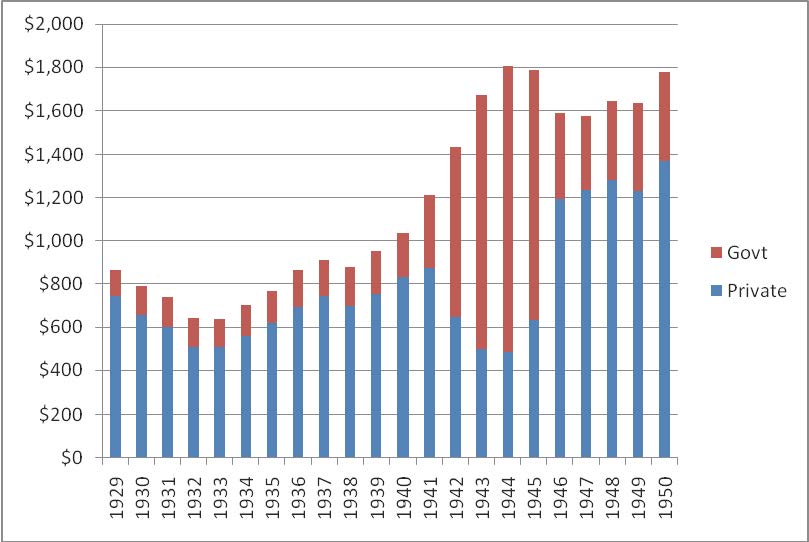

Now let’s get hip-deep in the actual numbers. Here are the official data for “Real Gross Domestic Product,” i.e. total economic output adjusting for changes in the purchasing power of the dollar. These are the government’s official estimates for how much “total stuff” the U.S. economy produced from 1929 through 1950:

Private and Government Components of Real GDP, 1929-1950

It is easy enough to see why the Keynesians think they have a slam-dunk case. Real GDP collapsed from 1929-1933. Then, with the start of FDR’s New Deal, output began a rapid recovery. However, the recovery faltered in 1938 (which the Keynesians blame on a foolishly early withdrawal of stimulus), meaning the country didn’t really escape the Great Depression until the massive wartime expenditures starting in the early 1940s.

As I mentioned earlier, the economic historian Robert Higgs has peer-reviewed articles and book-length treatments of these issues. Higgs has pointed out several problems with using the official GDP statistics as a gauge of actual economic prosperity.

For example, one major problem is that the government statistics count $1 million of military spending as the same amount of “real output” as $1 million of consumer spending on (say) automobiles. Yet this is wrong, because of the different institutional settings. When consumers voluntarily spend their money on automobiles, they are choosing to buy those particular goods rather than other ones, or rather than saving the money for the future. Thus, it is prima facie evidence that the “$1 million in vehicles” really do constitute a stock of output that confers genuine services to the new owners.

In contrast, when government officials steer $1 million to military contractors to purchase some new tanks, we have much less reason to believe that this is the same amount of “real output.” The money was obtained involuntarily through taxation (or through deferred taxation in the form of government deficits), so we don’t know that the citizens value the tanks as much as they’d value new cars with the same price tag.

Moreover, the government officials in charge of defense procurement can’t simply pocket the money if they choose not to spend it; their budgets are probably of the “use it or lose it” form, and in any event it would be very illegal for them to personally skim from tax funds. Rather, the way these officials can personally profit from their powerful positions is to steer sweetheart deals to particular companies, which then give plush “consultant” or “advisory” roles to these officials once they return to the private sector. So we can’t even say that the defense procurement officers value the new tanks as much as they would value $1 million of new cars if they had had that much money to personally spend.

Thus we see that there is no reason to suppose that the large military spending (which was the lion’s share of the “Government” purchases in the early 1940s) of World War II was comparable to the same amount of “Private” output. Therefore, the total GDP figures—as represented by the cumulative height in the figure above—are very misleading.

Yet the Keynesian case is weaker still. Suppose we accept, for the sake of argument, that $1 million of government spending is just as economically significant as $1 million of private investment or private consumer spending. Even so, the World War II era still doesn’t present a model for dealing with an economic depression.

Look again at the figure above. Even on the Keynesians’ own terms, private GDP—the share of the economy devoted to civilian purposes—was lower during the height of the war than during 1933, the very worst year of the Great Depression. When we take into account the increase in population during the decade in between, the impact on the homefront is even more astounding.

Let us suppose, then, that the government today did exactly what Paul Krugman recommends, and engaged in massive government purchases comparable to those during World War II. Yet rather than build tanks and bombers, instead the government today buys socially useful things (in Krugman’s vision) such as roads, bridges, parks, the services of additional police and firefighters, etc. If things turned out today the way they did during the war years, would Americans be happy with the result?

I suggest they would not; they would reject the bargain, even on Krugman’s own terms. Suppose people took today as equivalent to 1941, and then the country proceeded to have similar government spending and economic performance as the official statistics show happened during World War II. That means private economic output would fall a total of 55 percent between now and 2015, or at an annualized rate of about 24 percent per year. Does the average American household right now want to suffer a 24 percent annual drop in their private standard of living, for three years in a row? This would put their standard of living back to around 1984 levels (and again, I’m not even accounting for population changes). Would the average household’s answer be affected if we told them about how many potholes would be filled, and how many new schools would be built during those three years?

But wait, it gets worse. It’s not merely that there would be a 3-year period of extreme penury (in terms of private goods and services), in exchange for those things the government provides. After this burst of Keynesianism—again using World War II as the model, now by comparing 1941 to 1946—the federal government’s gross debt held by the public would have grown by a factor of five. Since the federal debt held by the public right now is about $10 trillion, that means mimicking the World War II experience would yield a federal debt of $50 trillion by 2017. This new fact is on top of the reversion to 1984 levels of private GDP. Again I ask: Is there any amount of new schoolteachers and bridges that would compensate for these two trends?

In conclusion, let me be fair and point out that Paul Krugman et al. think that private living standards dropped during World War II because of rationing, not because of a bug in Keynesian pump-priming. Maybe, maybe not. My modest point in this article is that taking the government’s own statistics at face value, the vast majority of Americans would not want a Keynesian “solution” to our current economic depression, the way World War II allegedly “solved” the last Depression.

As with the Obama stimulus package, so too with wartime “prosperity”: Keynesians can’t point to what actually happened as evidence of their policies’ effectiveness, but instead contrast what happened with what their models show would have been the alternative. In any absolute sense, Americans during the war years experienced a serious drop in living standards, as both the official statistics and the new research by Horwitz and McPhillips show.

Robert P. Murphy is author of The Politically Incorrect Guide to Capitalism. His blog is Free Advice. Follow him on Twitter.

Comments