QE Forever

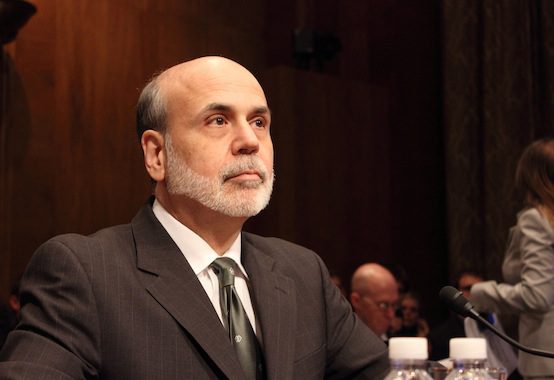

The Fed’s latest policy announcement—dubbed “QE3” by the pundits—has been fairly described as Bernanke going “all in.” Unfortunately, the Fed chairman is holding a losing hand, and he just wagered the entire economy. Printing money to “fix the economy” is exactly what got us into this mess, and it’s astonishing that so many analysts still fail to see the folly of the Fed’s actions during this crisis.

First of all, let’s review exactly what the Fed announced on September 13. Here is the key excerpt:

[T]he Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month.…

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved…

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.

In one sense, the Fed is simply doing more of the same. We have already seen unprecedented asset purchases—of both Treasuries and mortgage-backed securities—since the financial crisis struck in 2008, and yet the economy is still broken.

However, there are two subtle but important shifts in the Fed’s new announcement. First, rather than announcing a set dollar amount of total purchases, the Fed is effectively saying, “We will keep buying more MBS until it works.” In other words, this is an open-ended commitment by the Fed. Rather than having a built-in sunset clause as with previous “QE” announcements, this latest announcement means it will take a new policy decision to turn the spigot off down the road.

The other shift in policy is that the Fed is now saying it will leave the “stimulus” in place even after the economy is well into recovery. Many commentators (plausibly) argue that the Fed is giving a wink-wink acknowledgement that it will tolerate price inflation running higher than its official target of 2 percent, giving more weight to bringing down unemployment. Yet the Fed is being cryptic on the matter, so as not to arouse too much protest from the rubes who exhibit a knee-jerk hostility to scientific management of the economy—call it Tea Party “dog whistle.”

Notwithstanding the applause coming from various quarters—including even from ostensibly free-market economists—I have to side with the rubes on this one. I can’t believe distinguished economists think it’s a good idea for the Fed to create more money out of thin air, in order to prop up the mortgage market. It was Greenspan’s inflation that helped fuel the housing bubble, and repeated bursts of bond purchases in Europe have done nothing to solve their underlying crisis. At best, the Fed’s announcement of endless QE will simply postpone the day of reckoning, making the US crash all the worse when it finally hits.

The people applauding the Fed keep stressing that Bernanke isn’t yet “out of ammunition.” Yet this openly militaristic vocabulary should be a red flag to wise observers. When the government declares war on something—whether it’s poverty, drugs, or terrorism—it means we’re in store for a campaign that will cost trillions and take decades, at least. This notion that if Bernanke would just “take the gloves off and print some money, already!” that we’d solve this recession, is quite simply insane.

I use the term insane quite consciously, in the sense of repeating the same policies and expecting a different result. We must remember that Chairman Bernanke has already created more than twice as much “base money” since 2008, as all previous Fed chairs combined:

The above chart, by itself, doesn’t settle the debate, but it should give definite pause to the analysts who keep wondering why Bernanke isn’t “doing more.”

Another odd feature of this latest Fed announcement is that many commentators point to the surge in stock prices as confirmation that the policy was a good thing. But nobody denies that the Fed can buy a bunch of assets and fuel a bubble in the stock market. Our worry is that it will come crashing down. Again, a little historical perspective is in order:

The above chart shows the nominal level of the S&P 500 index. Note that the repeated bursts of QE since early 2009 have corresponded with the reflation of stock prices. Is it really going to be shocking when—for some “inexplicable reason”—the market crashes again? How many times will we go through this cycle, before economists—especially those in the free-market camp—stop calling on the guy with the printing press to “fix” things?

The above chart shows the nominal level of the S&P 500 index. Note that the repeated bursts of QE since early 2009 have corresponded with the reflation of stock prices. Is it really going to be shocking when—for some “inexplicable reason”—the market crashes again? How many times will we go through this cycle, before economists—especially those in the free-market camp—stop calling on the guy with the printing press to “fix” things?

If the fundamental problem with the U.S. economy these past four years really has been about “demand”—that businesses and households just aren’t spending enough—then further money-creation by the Fed could plausibly help promote recovery.

Yet suppose that the fundamental problem is a “real,” structural one, in which resources have been misallocated across various sectors due to prior Fed inflation and counterproductive government policies. In this scenario, the Fed’s latest announcement of open-ended purchases—in an effort to prop up housing, the very sector that was responsible for our previous financial catastrophe—represents the worst possible remedy. Bernanke and the rest of the Fed policymakers would be sowing the seeds of an even bigger crash down the road, one that will make 2008 look like a walk in the park by comparison.

Robert P. Murphy is author of The Politically Incorrect Guide to Capitalism. His blog is Free Advice. Follow him on Twitter.