Cuomo is Guilty of the Subprime Mortgage Crisis Too

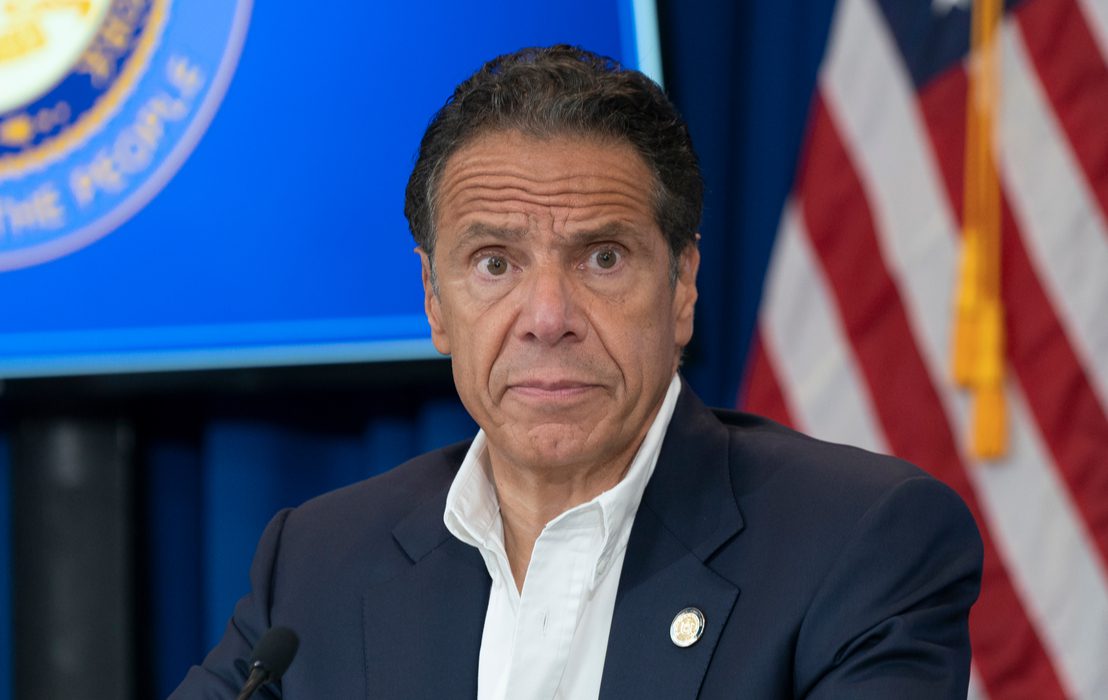

A friend of mine once said in a WhatsApp group chat that former New York Governor Andrew Cuomo could be the Democratic candidate in 2024.

The thought made me shudder, and that was before his state requirement that forced nursing homes to take back residents who had been hospitalized with Covid-19 once they recovered. That move led New York’s attorney general to accuse Cuomo of undercounting nursing home deaths by several thousand, and possibly increased infections and deaths. It was also before he was recently accused of sexually harassing multiple women who worked for him, which led to his resignation Tuesday, August 10.

So, if it was not for thought of those incidents that I shuddered, then what was it? It was Cuomo’s role in the subprime mortgage crisis, which he still has not been held fully accountable for. That malfeasance merits revisiting as the 13-year anniversary of the collapse of Lehman Brothers fast approaches.

Politics is, apparently, a vocation where it does not matter if you were a complete failure in a previous role—the chances of getting promoted are still high. Cuomo’s part in the worst financial disaster since 1929 proves that.

Of course, Cuomo’s contribution does not excuse the other culprits in the 2008 recession, such as Alan Greenspan and his loose monetary policy, former Massachusetts Rep. Barney Frank, who blocked the Bush administration’s efforts to reform mortgage giants Fannie Mae and Freddie Mac, or President Bill Clinton. But Cuomo’s role in this event must be explored because it shows that he should never have been allowed to become New York’s governor in the first place.

In the late 1990s, Cuomo was appointed Clinton’s secretary of Housing and Urban Development (HUD). Under his watch, HUD oversaw the easing of lending standards on Federal Housing Administration home loans, with the maximum size of FHA-approved loans for single-family homes in low-cost areas increasing from $86,317 to $121,296, while minimum down payments fell from 7 percent of the asking price to 3 percent.

At the time, the then housing secretary wanted to reduce redlining, a term describing home-lending practices that discriminate against ethnic minorities. Here he is in a YouTube clip admitting that by asking the banks to take on more risky loans, their portfolios were at a greater risk of defaulting. He also bragged that he sued a bank in Texas for redlining.

Susan Wachter, who served as assistant secretary for policy development and research at HUD under Cuomo, told Institutional Investor that easing lending standards was probably not a good idea.

Many of Cuomo’s defenders, such as Richard Bamberger, his spokesman when the then housing secretary was New York’s attorney general, suggested he made HUD “a revitalized engine for economic development.” But try telling that to a family that lost their home because of the Clinton administration’s fluffy thinking that regardless of their income, anyone can become a homeowner.

Even Dean Baker, founder of the Center for Economic Policy and Research, who believes that Fannie and Freddie’s role in the subprime mortgage fiasco is negligible, criticized Cuomo in 2010 for failing to require that mortgage lenders disclose the terms of the mortgages the government sponsored entities (GSEs) were underwriting.

But Cuomo’s responsibility for America’s mortgage meltdown goes much further than that. Village Voice journalist Wayne Barrett has outlined how Cuomo forced Fannie and Freddie to significantly increase the number of “affordable,” low-to-moderate income loans that the two GSEs would have to buy. Fannie and Freddie don’t sell mortgages to borrowers. They buy them from banks and mortgage companies, allowing lenders to replenish their capital and make more loans. They also purchase mortgage-backed securities, which are pools of mortgages frequently acquired by the GSEs from investment firms. The government enabled these banks to add money into the mortgage market and create a strong enough profit to entice shareholders.

Ever since 1992, the law forced HUD’s secretary to set housing goals and ensure that objectives were being achieved. Unlike his predecessor, Henry Cisneros, who pushed Fannie and Freddie toward a requirement that 42 percent of their mortgages serve low- and moderate-income families, Cuomo raised that number to 50 percent and instantly hiked GSE mandates to buy mortgages in underserved neighbourhoods. This policy was deemed risky by many at the time, including Franklin Raines, the Fannie chairman and first black CEO of a Fortune 500 company. However, Timothy Howard, Fannie’s chief financial officer, disagreed with his boss. Even the New York Times wrote an article in 1999 warning about the dangerous implications of the Clinton administration’s tinkering with the GSEs.

Although Cuomo went on to deny his role in the 2008 recession during his first campaign to become New York’s governor, his own report on Fannie and Freddie’s new goals in 2000 highlighted how GSE presence in the subprime market could be of “significant benefit” to minorities. By the time the Bush administration expected the GSEs to purchase 56 percent of subprime mortgages in 2004, HUD reported that Fannie had gone from $1.2 billion in subprime security purchases in 2000 to $15 billion in 2002. In 2003 alone, both GSEs bought $81 billion in subprime securities.

As Paul Sperry argued in a Fox News column, it is a pity that the Financial Crisis Inquiry Commission, led by Democrat Phil Angelides, which held 19 hearings in its 15 month, $10 million investigation, never interrogated Cuomo. Instead, they were quick to pin the blame entirely on Wall Street and deregulation. HUD bullied Countrywide Financial and hundreds of mortgage lenders into signing so-called Fair Lending Master Agreements targeting minorities with subprime loans. It is no wonder the banks thought they could get away with dangerous subprime lending and the government would bail them out.

Sadly, Cuomo may never admit his role in devastating the world economy before the housing bubble burst in 2007 and 2008. His policies devastated the lives of millions of families who lost their homes back then, and when he was New York’s governor, he wrecked people’s lives again with his lockdown policies. Though he sued many big banks as New York’s attorney general during the 2000s, he seems to have failed to realize that, ironically, he was suing them for the lending practices that he encouraged in the late 1990s.

Today Cuomo has many things to feel guilty for, but one day he should admit that the subprime fiasco is one of them. One thing is for sure, though—his track record as Clinton’s HUD secretary and as New York governor proves he was a disastrous politician, and he should have resigned far sooner.

Matt Snape is a freelance journalist who has worked for Inside Over/Il Giornale, Blasting News, Hot Cars, and HITC, and had articles published in The i Paper and the Metro.

Comments