Uncertainty’s Prophet

The Great Recession was not simply the bursting of an economic bubble. This middle-class recession also saw the bursting of a bubble of optimism, dating back to the Reagan-Thatcher era, in what the economy can do for human society. It’s not just markets that lurch from good times to crisis; the same is true of underlying sentiment about the economy as well.

The principles of the Reagan-Thatcher era were clear in rhetoric, if not always successfully translated into policy. The program was to reduce government intervention in the economy, lessen the burden of regulation and taxation, and privatize state-owned industry. The thinkers commonly cited in support of these efforts were Milton Friedman and Friedrich von Hayek, along with a handful of other Chicago School and Austrian School economists.

Recessionary times have swept all of this away and ushered in a new era of Keynesianism—to the point that we are all Keynesians now, again. The pendulum has swung back and forth several times. We should recall that prior to Keynes economics was essentially a free-market discipline. Keynes mounted an intellectual assault on the free market, contesting both the classical view of economics derived from Adam Smith and the Austrian understanding of many of his own contemporaries. He wanted to bolster the role of government in managing society in the modern industrial age, which appealed in the postwar world and appeals again today.

There is a general sense these days that the economy is not fulfilling our needs, which makes this a pivotal moment. Trotting out Reagan-Thatcher economic ideas in response is akin to lighting up a cigarette in public—there are places for it, but it is socially unacceptable to most company. We could, however, turn to Friedman’s old teacher, Frank H. Knight (1885–1972), to find a more fitting conservative economist for our difficult times.

Knight argued that Keynes, like the socialists, had too much confidence in government’s ability to solve economic problems. But did the Chicago and Austrian economists also have too much confidence in markets? Knight certainly thought so. As a professor at the University of Chicago, he was in fact a co-founder of what came to be known as the Chicago School—his students included George Stigler, James Buchanan, and Gary Becker, as well as Friedman—but his ideas nonetheless defy easy classification.

His first and main work was Risk, Uncertainty, and Profit, published in 1921, the same year that Keynes published his book on probability. Knight’s book established the notion of “Knightian uncertainty” in economics, drawing the important distinction that while “risk” can be calculated and insured against, it is true “uncertainty” in the world that paves the way for opportunities to create profit and entrepreneurial enterprise.

Knight had various testy engagements with the Austrians and Keynesians. His core argument with Hayek was over capital and interest theory. He disputed the same topics with Keynes, but his greater concern with Keynes was the latter’s view that government can drive the economy: he believed that Keynes had largely recycled old fallacies. Knight argued that capital in a growing society is immortal, meaning that production has no beginning or end, unless the end of the world is known and the entire economy is able to prepare for it.

He thus rejected the classical notion that production is the result of labor and the Marxist spin on this that labor creates wealth. Wealth in an object is the capitalization of a perpetual income, and for Knight production cannot be broken down into this object or that slice of time. While the Austrians argued that production is a series of inputs and outputs, Knight disagreed, contending instead that the notion of a definite relation between the quantity of capital and time or length of production needs to be eliminated.

In other words, he managed to annoy just about everyone. For Knight, economics is not the dismal science because it is not really a science at all: it is a way of thinking about scarcity in the world and human behavior in light of this scarcity. He warned of the uncertainty of our human activity and economic arrangements, argued that we should not take too much comfort from our theoretical approaches, and doubted the predictability of outcomes.

It is from this philosophical base that we can view Knight as a conservative economist for our uncertain age, though we will not find here a raft of policy options. While he taught economics and wrote technical scholarly works, his lasting legacy is his philosophical approach to his field. Knight was a critically minded supporter of capitalism, and his ultimate concerns focused with a deep sense of realism on the spiritual and behavioral state of society.

Fashioning what he called an onus probandi in favor of conservatism, Knight pointed out that primitive society was wise in its traditional habits since those who adhered to them knew that people and groups had previously thrived by following them. The hubris of liberal society is that it acts frivolously in switching over quite suddenly to an opposite set of assumptions: that the new is better than the old and the good consists in change and not stability.

This principle led Knight to a practical view of our economic and political arrangements and a suspicion of government, bureaucrats, and schemes that would seek to guide us to a better life. He had an understanding of human nature that he shared with political realists and theologians of the time, which is the notion of a fallen nature of humanity and the very concrete existence of such fallen people. It is real fallen people who act in the economy, not the ideal homo economicus of textbook theory.

In Knight’s dissent from the economics profession, he deeply mistrusted reformers. Economic progress gets stalled because of people and power, not systems. He told the 1950 meeting of the American Economics Association that when someone asks for power to do good, his impulse is to say, “Oh yeah, who ever wanted power for any other reason? And what have they done when they got it? So, I instinctively want to cancel the last three words, leaving it simply ‘I want power,’ that is easy to believe.” Knight believed the “new” liberals—New Dealers and welfare statists—simply confused freedom with power.

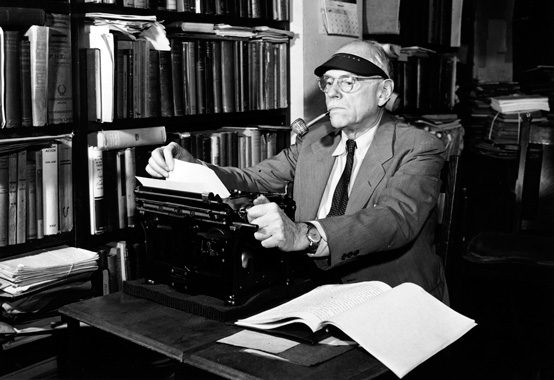

Because of his fascination with human nature and theological questions, along with his debatable atheism, his students sometimes quipped, “There is no God, but Frank Knight is his prophet.” The joke was, however, fortuitous. Knight stands firmly in a prophetic tradition—not for him the social graces of the corridors of power, where economic policy is made. If we think of a prophet as someone who reveals laws, speaks to the nature of persons as they are, and warns them of the path they should tread and the outcome of their errors, then Knight is a prophet indeed.

This scholar, whose curmudgeonly persona would not be out of place next to a Jeremiah or Isaiah, pursued economic truths and cajoled us in the hope of eliciting a realistic response. He warned progressives that the desire to change society economically is a fool’s errand. He warned conservatives, in turn, against the complacency of those who benefit from the organization of economic life without much thought for those who lose out.

The confidence in the economy that took root in the 1980s would have made Knight very uncomfortable. He would have seen this as trading one dogmatism for another. His prophetic voice drew attention to the state of dissonance we experience in the economy—to the inevitability of inequalities and uncertainties that can only be addressed by discussion and action, not theories.

He believed that progressive reformers and welfare advocates did not understand economics and were equally ignorant of their own ethical ideals, the relationship between economics and law, and the cultural process. Yet he also rejected the thought that a successful economy will solve all the problems, because there are inherent social faults to be addressed. This hope in market liberalism, tempered with a deep sense of the limitations of humanity, may serve us well in contemporary debates about the economy, as conservatism in America seeks to move on from the economic debate of the 1980s and address today’s crisis of confidence in the economy.

He believed that progressive reformers and welfare advocates did not understand economics and were equally ignorant of their own ethical ideals, the relationship between economics and law, and the cultural process. Yet he also rejected the thought that a successful economy will solve all the problems, because there are inherent social faults to be addressed. This hope in market liberalism, tempered with a deep sense of the limitations of humanity, may serve us well in contemporary debates about the economy, as conservatism in America seeks to move on from the economic debate of the 1980s and address today’s crisis of confidence in the economy.

While many on the right may want to leave behind the Chicago of Friedman and monetarism, they still don’t wish to embrace Keynesian, progressive, or collectivist approaches. Meanwhile, people on both sides of the political spectrum still take comfort in a simplistic dichotomy between the “pro-business” GOP versus the “pro-government” Democrats. A more useful effort for conservatives today, however, is to head back to the Chicago of Frank Knight and his prophetic exploration of economic life and human behavior; what he teaches us may lead to a more productive dialogue between conservatives and liberals about our economy and its limits.

Knight can shed light on contemporary concerns about equality, monopoly, and market cycles, so we can improve the political debate. What market opponents see as built into the economic system are in fact reflections of how people and firms act in the economic organization of society. Conservatives may need to think of policy options that include some restraint on business practices, while progressives would have to accept the need to decrease bureaucratization of the economy and restrict the role of government. Knight deserves reconsideration for what his insights show us about the soul of our modern economy.

David Cowan is the author of Frank H. Knight: Prophet of Freedom.

Comments