The Norquist Anti-Tax Pledge is Cracking — And That’s a Good Thing

Grover Norquist’s anti-tax dogma is slowly losing its grip on Republicans in both chambers of Congress. The Washington Post’s Chris Cillizza has a handy rundown on the growing crop GOP defectors, but for brevity’s sake, they are Sens. Lindsey Graham, Bob Corker, and Saxby Chambliss, as well as Rep. Peter King. This is on top of Speaker John Boehner’s pithy characterization of Norquist as “some random person” (if only!).

Count me as unapologetically happy about this development.

It’s not that I’m thrilled by the promise of higher taxes.

Rather, I think the party, and the conservative movement at large, is long overdue in recognizing that the Norquist pledge has proved a spectacular failure on its own terms. The pledge was more than simply a safeguard against tax increases; it was a means to an end. Norquist memorably described that end thusly: “I don’t want to abolish government. I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.”

And how’d that work out?

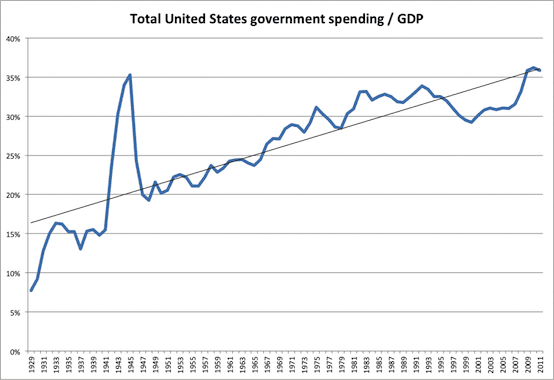

This chart, created by Josh Barro, shows the trendline:

The pledge arrived on the scene in 1986. And we do see, in Barro’s chart, a dip in federal spending as a share of GDP, beginning around the time of the Clinton administration. Barro explains that, during that period, we “caught lightning in a bottle … and can’t plan on doing so again”:

Of this 4.7 percentage points of GDP decline in government spending, nearly all (3.9 points) is attributable to the federal budget. About half of that (1.8 points) is the “peace dividend”: reductions in federal defense spending after the Cold War. A quarter (0.9 points) is reduction in net interest expense, as interest rates fell and so did the size of the public debt relative to GDP. Other key contributors were declines in non-defense discretionary spending (0.4 points) and in Social Security (0.5 points), the latter likely attributable to favorable demographics, as the Baby Boomers were in a peak earning period while a relatively smaller generation was retired.

In other words, the Norquist pledge had little if anything to do with the healthy fiscal position of the 1990s. And when it really mattered — during the Bush era, with its simultaneous wars and spike in spending — it was a limp slice of Swiss cheese. Congress lowered tax rates, while spending went up, up, up. Rather than inducing lawmakers to hold the line on the size of government, it served as an excuse to charge the binge to the federal Mastercard.

In retrospect, the Norquist anti-tax pledge was an emblem of blind-spot budgeting: it focused on revenue inputs and … what — hoped for the best on outputs?

The Republicans who have thus far publicly broken with Norquist have done so in the name of holistic budgeting — getting spending more in line with revenue. They realize that a deal with Democrats on revenue will create room for compromise on entitlements. Yielding on taxes, in other words, will accomplish the goal of actually shrinking government as a share of the economy.

If Norquist loses, logic wins.

Comments