War Is A Business So Expect It To Blow Up

While the shouts of defiance rose up in Iran and Iraq after U.S. drone strikes killed 25 fighters on Dec. 29 and Iranian Gen. Soleimani and nine others on Jan. 2, a tiny cry could be heard along the I-395 and I-66 corridors inside and outside the Capital Beltway. Listen closely or you might miss it: the collective sound of hushed elation among the defense industry’s shareholders and executives as they see contracts dancing in front of their eyes and stock prices soar over the last five days.

“War is a business” is a deadly serious cliche made no less serious for its generous use. Spend a few years in the DMV (D.C./Maryland/Virginia metro area) and it is an unmistakable truth. Tens of thousands of jobs depend on the severely bloated National Security State—whether it be in hardware (Lockheed, Raytheon, Northrop Grumman, General Dynamics) or surveillance-intelligence (Booze-Allen, SAIC, CACI) and everything in between—and all of those people work, live, and vote here. This, as Mike Lofgren wrote before it ever became a thing, is the real “Deep State.”

As war is afoot, the Deep State, or if you like, the Military Industrial Complex, gets a full dose of Vitamin D, and so do the stocks for all private industry involved.

According to Forbes today:

In the wake of U.S. air strikes that killed Iranian General Qassem Soleimani last week, ‘war stocks’—companies in the defense industry—have climbed: Over the last five days of trading, the SPDR S&P Aerospace & Defense ETF (XAR) rose almost 4%, while the iShares U.S. Aerospace & Defense ETF (ITA) was up 2.5%.

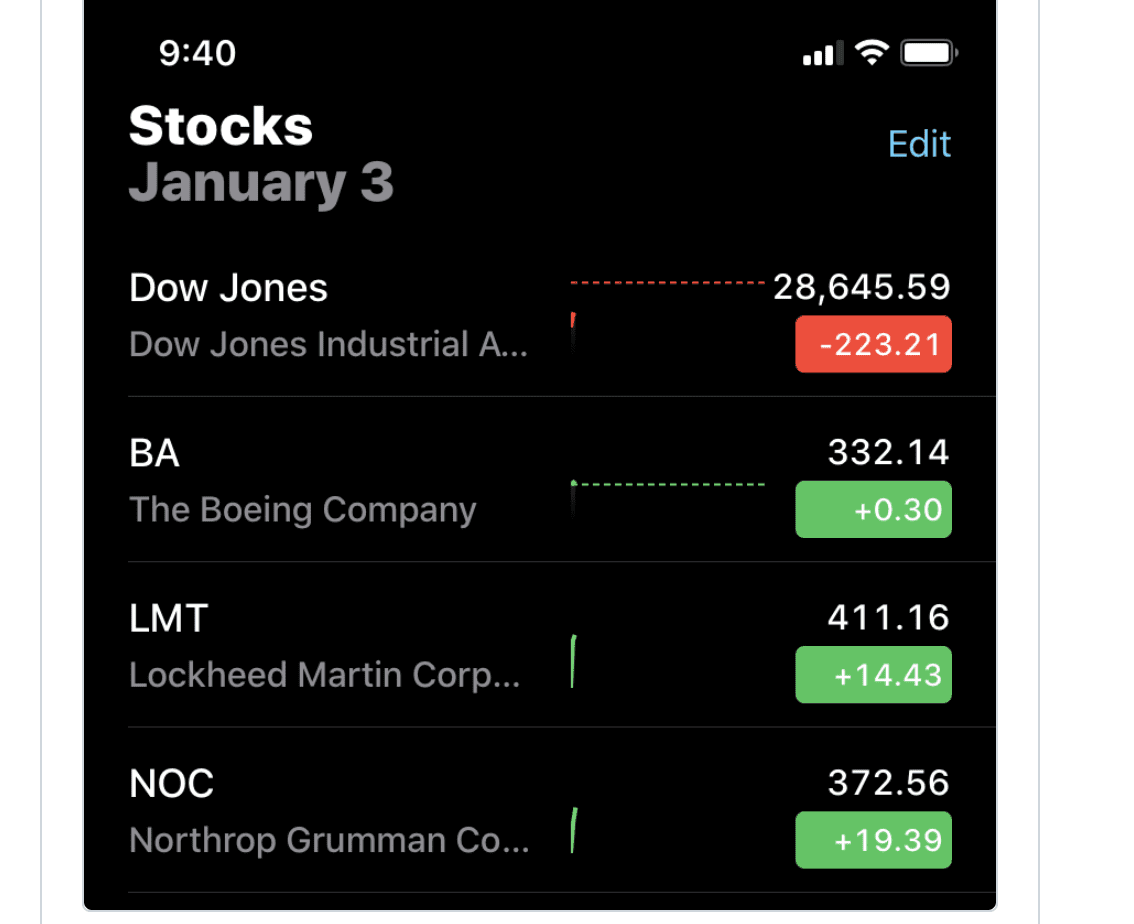

Big-name defense stocks are rising, with Northrop Grumman leading the rally last Friday. Northrop has risen 8% in the last five days, while Lockheed Martin and Raytheon have jumped around 4% and 2%, respectively.

And it is not just the DMV that has cause to celebrate today. From the Los Angeles Times:

AeroVironment Inc. advanced 6.9%. The Simi Valley company makes small, short-range reconnaissance drones that U.S. soldiers use. The increase in troop deployment to the Middle East could mean more business for AeroVironment, said Ken Herbert, managing director with investment banking and financial services firm Canaccord Genuity.

The surge in defense stocks was readily highlighted on corporate television programs like Fox Business and in publications like Investor’s Business Daily, which noted that “Northrop Grumman (NOC) and Lockheed Martin (LMT) were big winners in Friday’s stock market trading, along with Raytheon stock.”

Citigroup analyst Jonathan Raviv wrote Friday that “if Middle East conflict were to ratchet up…we think it could be tougher for Democratic Party electoral candidates to argue against a stronger defense budget in 2020.”

Not all of them. According to CommonDreams writer Jake Johnson, Rep. Ro Khanna (D-Calif.) and Sen. Bernie Sanders (I-Vt.) have proposed legislation to stop Pentagon funding for U.S. military action against Iran. Khanna, who is a dedicated non-interventionist and realist who has fought hard to end U.S. assistance of Saudi Arabia in the Yemen war, tweeted late Friday that “if you are wondering who benefits from endless wars, take a look at how stocks for weapons manufacturers began to rise as soon as Soleimani was killed.”

“Defense contractors spent $84 million lobbying Congress last year,” Khanna noted, “and it certainly wasn’t to promote diplomacy and restraint.”

Remember that the next time you see the war porn commercials by Lockheed and Northrop Grumman during NFL football games. This is their time to shine, and it has little to do with patriotism. Expect nothing nothing less than a feeding frenzy as everyone swings in to get their piece in the coming days and weeks.

Comments