This Stat Will Make Your EPOP

I don’t know why Kevin Drum went with a snarky header (well, actually I do, but that’s not a reason I’ll endorse), because this seems like a really good measure of employment to be following (courtesy of Jordan Weissmann):

The BLS even produces a data point that Trump himself might like: The employment-to-population ratio for adults between the ages of 25 and 54—or “prime-age EPOP.”…It gives us a raw look at the employment rate, without any fancy caveats about who is and isn’t part of the labor force. And because it only tracks workers 25 to 54, it isn’t really distorted by the wave of retiring boomers or growing college attendance. It’s a simple snapshot of the portion of the population we most need to worry about….Best of all, from Trump’s perspective at least, prime-age EPOP has plenty of room for improvement….If Trump wants to argue that Obama left him an economy that was still hurting, this is one stat that will easily help make the case.

And look: it does!

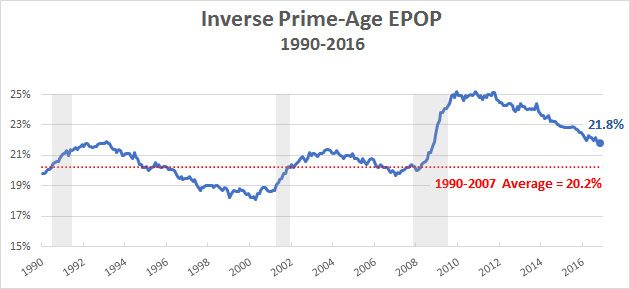

That’s actually the inverse of EPOP, a measure not of who’s employed but who isn’t, so it’s more directly comparable to the unemployment rate. In other words, this is everybody of prime age who is not working — whether they are unemployed, discouraged, back in school, staying home as a full-time parent, whatever.

And, as the chart clearly shows, the Great Recession really did a number on workforce participation, with about 5% of this prime-age cohort dropping out. And the recovery has been weak. Even after the recession ended, participation didn’t start to improve for a couple of years. And now, with the recovery decidedly long in the tooth, we’re still only back to a level comparable to the peaks after the last two recessions.

Right now, the unemployment rate is 4.7%. But 21.8% of prime-age potential workforce is not gainfully employed. That’s about where this measure was in 1992, when the unemployment rate was 7.5% and Clinton rode to victory on the slogan, “It’s the Economy, Stupid.”

I highly doubt that this measure can be explained by more people staying at home to parent full-time, or engaged in full-time education or training that will provide them with skills and credentials to improve their income. It’s partly explained by the explosion in disability claims — but that should be no comfort at all. Ultimately it is what it looks like: evidence that the recovery, at least in terms of employment, isn’t nearly as good as it looks (and that the recession that preceded it was arguably worse than it looked at the time).

This isn’t an anecdote. It’s data, data that confirms what the last election told us: that while by some important measures the economy really has recovered, by other measures there is an awful lot of pain out there, pain from the persistent lack of remunerative employment. And I’d wager anything that if you sliced this measure geographically, you’d see much better numbers in both red and blue states where Trump underperformed than in the states that put him over the top.

We should be watching this measure — not only because it’s a good way to monitor the administration’s economic performance, but because alternative approaches the opposition may tout better speak to it if they want to get traction.

Comments