Some Like It Hot

Economic performance under each president is a topic of endless partisan wrangling, with cherry-picked metrics, timeframes, and baselines proving one’s preferred administration a triumph and the opposition’s a calamity—all of which requires the further, questionable assumption that the identified effect has presidential policy as its cause. Even by these low standards, interpretation of the Trump administration’s economic record already suffers from a Rashomon-like divergence of self-interested narratives. Democrats argue that the economy’s strength prior to the onset of the COVD-19 pandemic was inherited from President Obama and that trendlines mostly carried forward existing momentum. Republicans credit President Trump for presiding over a nearly unprecedented boom but, depending on their own policy preferences, attribute it to either the conventional “supply-side” agenda of tax cuts and deregulation or else to Trump’s willingness to reject that agenda on issues like trade. As in Rashomon, none of these stories holds water.

The American economy did generate impressive results on some dimensions in 2018–19, far better than what the pre-Trump trajectory would have predicted, but those dimensions do not include the ones that supply-side policies are supposed to influence. Put bluntly: the Trump administration’s tax cuts did not quickly spur investment, dynamism, and growth. As for the agenda most associated with Trump himself—rejecting Republican orthodoxy on issues like free trade and purportedly focusing on concerns of the working class—it went mostly unrealized. Where pursued, the policies were not ones that would generate results in so short a timeframe regardless.

What differentiates the Trump policy environment, and best explains the excellent outcomes experienced by workers, is the extraordinarily stimulative monetary and fiscal policy pursued at the peak of the business cycle. Never has America run its economy so “hot,” and the results speak for themselves. But such a strategy is neither sustainable nor sufficient in the long-run; at some point, investment and productivity must rise if prosperity is to spread. So while the success of the Trump economy holds important lessons, the question of where conservatives go from here remains an open one.

The Blue-Collar Boom

As the COVID-19 tsunami swept toward American shores, the nation’s economy was enjoying the eleventh year of its longest expansion on record. A tight labor market continued tightening beyond what economists considered the point of “full employment” where everyone who wants a job can find one. Employers, faced with more jobs to fill than workers to fill them, were forced to bid up wages and draw additional workers off the sidelines. The results appeared in paychecks and household incomes.

The labor-market data are by now familiar and mostly speak for themselves. After hovering around 5 percent through 2015–16, the unemployment rate fell to 3.7 percent in late 2018 and averaged less than 4 percent through all of 2018–19. The consecutive readings of 3.5 percent in November–December 2019 were the lowest since the late 1960s. Prospective workers were returning to the labor force: The share of prime-age men working full-time, which had fallen as low as 73 percent in the Great Recession’s aftermath, reached 82 percent. The Social Security Disability Insurance rolls, which had doubled to nearly 11 million between 1993 and 2013, had fallen 10 percent by 2019. With the labor market’s tightening came wage growth, which reached its highest level since the Great Recession.

Remarkably, the strongest gains appeared among historically disadvantaged groups. For instance, the unemployment rate for prime-age Black men had risen to 19.7 percent in March 2010, creating a gap of almost 9 points above the rate for prime-age men overall. By November 2019 that level had fallen to 4.2 percent, closing the gap to less than 2 points. Whereas annual wage growth for college graduates had outpaced that of workers with a high school degree (or less) by more than a full point in the late-1990s boom and by close to a point in the mid-2000s, in 2018–19 they had drawn even. Likewise, while the top quartile’s wages had typically grown faster than the bottom quartile’s from 2002–14, in 2018–19 the bottom quartile’s annual growth was faster by more than a full point.

All these trends resulted in impressive gains for household incomes. Median household income rose 6.8 percent (more than $4,000) from 2018 to 2019, to an all-time high of nearly $69,000. This was the largest one-year increase on record and more than double the total increase realized from 2000 to 2018. The poverty rate fell to an all-time low of 10.5 percent. All this deserved celebration. But why did it happen?

The Supply-Side Story

Advocates for the standard Republican playbook of tax cuts and deregulation argue that the Trump administration pursued precisely that course, and that the economic results offer vindication. The “rising tide,” they say, “lifted all ships.” But at least with respect to the Tax Cuts and Jobs Act of 2017 (TCJA), policy bears no causal relationship to the economic data. The ships are up, but the tide never came in.

The failure to supply a supply-side boom is most obvious in the investment data, which show no discernible uptick. Lower tax rates were intended to induce higher investment levels. But as Aparna Mathur, a senior economist at the White House Council of Economic Advisers (CEA), observed in September 2019, “it would be fair to conclude that there has been no discernible break in trend since the TCJA.” Mathur made this observation while a resident fellow at the American Enterprise Institute, and host of a symposium on the TCJA’s impact. At best, concluded a range of participants drawn from across the political spectrum, it was too soon to tell if the TCJA would deliver. But this, of course, means it could not be responsible for the economy’s performance to date.

In the months prior to the pandemic’s onset, the trend headed the wrong direction. The annualized growth rate for gross private domestic investment fell for four straight quarters in 2018 and 2019, just as overall economic performance was peaking. Real investment was lower in Q4 2019 than Q4 2018, the first year-on-year decline since the Great Recession. Having failed to influence investment, the tax cut’s benefits to corporations likewise appeared not to reach workers. Stock buybacks, on the other hand, surged by more than 50 percent.

The case for deregulatory success is stronger. As Wells King describes in “The Potpourri Presidency,” the administration made numerous efforts to deregulate and succeeded at least in slowing the pace of new regulation. The dividends of such efforts would appear in measures like productivity growth and new business formation, both of which did show improvement.

Productivity growth is the sine qua non of long-run increases in prosperity, but it has proved elusive in recent years. While annual growth averaged 2.8 percent in the post-war period during 1948–73, and a still-respectable 1.9 percent during 1974–2005, it stalled in the years after the Great Recession, averaging only 0.7 percent during 2011–16 and exceeding 1 percent only once in that period. Beginning in 2017, the rate climbed—to 1.2 percent, then 1.4, percent, and then 1.7 percent in 2019. While still quite poor by historical standards, this at least represents significant progress, and the sort of progress for which reduced regulation might claim some credit.

Likewise, business formation is vital to economic health, struggled in recent years, and should respond to the regulatory environment. After plunging in the Great Recession, firm creation bounced back slowly and had barely recovered their pre-recession levels by 2015 before falling slightly in 2016. The years 2017–19 all saw gains.

The supply-side metric to rule all others is growth in gross domestic product (GDP), and here—despite the labor market’s excellent results—the data are unavoidably poor. Real GDP growth fell each year of the Trump presidency, from 2.7 percent in 2017 to 2.5 percent in 2018 to 2.3 percent in 2019—a rate lower than the 2.4 percent averaged during President Obama’s second term.

The MAGA Story

Advocates for the “Make America Great Again” platform on which Trump won the presidency in 2016 see in the strong economic results a vindication of his political and economic heterodoxy and his efforts to support domestic producers and workers. The problem with this view, as Julius Krein shows in “A Populism Deferred,” is that the Trump administration never translated the rhetoric into a coherent agenda. It did not implement an industrial policy to effect a significant reshoring of supply chains, nor spur waves of new investment in innovation, nor lead a major push on infrastructure, nor pursue aggressive education or labor reforms, nor confront the rent-seeking in the financial or technology sectors.

The exception that proves the rule is China, where the administration paired rhetoric with action, most prominently a broad package of tariffs. Imports of Chinese goods fell by 16 percent in 2019—by far the largest decline since China joined the World Trade Organization in 2001. By comparison, imports fell by 12 percent during the recession in 2009, the only other year to see a double-digit decrease. The Trump administration’s aggressive negotiating posture yielded the “Phase One” agreement in early 2020, which featured commitments from China to purchase more American goods and curtail some unfair trade practices.

But because the China policy was not part of a larger trade strategy or a program to boost domestic industry, its initial economic effect was a shift toward production in other foreign countries—imports from the rest of the world rose 2 percent in 2019, so that total imports were nearly unchanged. Meanwhile, exports to China fell by 11 percent, the largest decline since 1990, with no offsetting gain in exports to other countries. Real U.S. manufacturing output peaked in 2018 below its 2007 high and then declined in 2019. In combination, the net effect was that America’s global trade deficit in goods fell only slightly in 2019 and remained the second largest on record, just behind the all-time high set in 2018.

Unsurprisingly, then, the labor market’s overall strength does not appear to have stemmed from a manufacturing boom. The sector did add more than 400,000 jobs in 2017–18, better than any two-year period of the Obama administration, which had the benefit of a Great Recession baseline. But the gain in 2019 was only 61,000 jobs. Productivity growth in the sector also remained painfully low—after four straight years of decline during 2014–17, it mustered only a 0.3 percent gain in 2018 and 0.1 percent in 2019, with the last three quarters of 2019 all running negative.

The lack of structural economic reform is also apparent in geographic data, which show that struggling regions continued to fall further behind. The Economic Innovation Group’s Distressed Communities Index divides all U.S. zip codes into five quintiles from “prosperous” to “distressed” based on factors like poverty rate, labor-force participation, and business and employment growth. The lowest two quintiles, classified as “distressed” or “at risk” in 2000, saw the lowest rate of job growth during 2007–16 and then continued to experience the least growth during 2017–18, the last year for which data are available.

Perhaps the fairest grade for both the supply-side and MAGA agendas then is not a letter, but an “Incomplete.” Of the two, the tax-cutting comes out the worse for having been tried aggressively and found wanting, and for results that were not just elusive but seemingly negative.

To distract from this reality, some supply-siders have tried instead to declare MAGA the failure, or even blame it for tax cuts yet again underdelivering. It is foolish, though, to insist in one breath that tax cuts just need more time and then in the next to declare efforts at remaking the global trading system a failure on the basis of results in year two. This repeats the unfortunate pattern in which factories and industries offshored by free trade are explained away as the inevitable disruption that accompanies greater, aggregate, long-run gains, while factories and industries harmed in the short-run by a more confrontational trade strategy are held immediately aloft as proof of a flawed strategy. Whether the economy’s general equilibrium will land higher or lower in a policy environment that emphasizes domestic industry is not a question that the first-order effects in the first few years can resolve.

The Stimulus Story

How could the economy generate such strong labor-market outcomes despite low growth, weak investment, stagnant productivity, and declining exports? The answer lies in fiscal and monetary policy, which both operated as if the nation were mired in recession. Attempting to stimulate an economy at the top of a record-long business cycle yields interesting results.

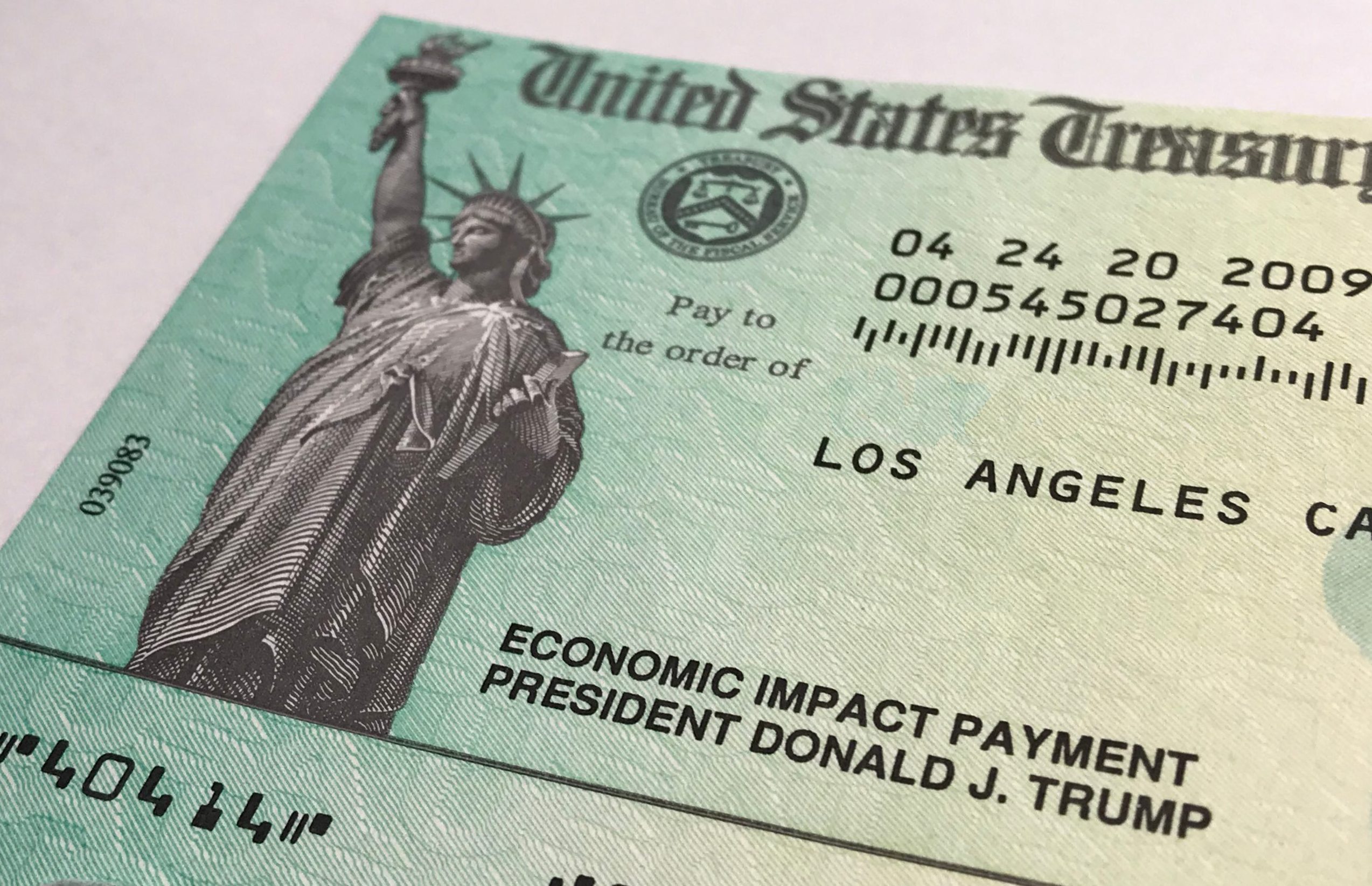

In fiscal policy, the federal government’s budget deficits in 2018–19 were unprecedented. The 2019 deficit, which reached 4.6 percent of GDP ($1 trillion), was the largest ever run outside the context of a war or recession. By comparison, the deficit in 2007 at the peak of the prior business cycle was only 1.1 percent. Both during 1999–2000 and in 1969, the last two times the unemployment rate dipped below 4 percent, the budget was in surplus. Ironically, the TCJA’s main effect has likely been as a deficit-expanding fiscal stimulus, though its supply-side evangelists would deny such an effect even exists. A traditional stimulus program entails the government borrowing idle capital and spending it during a period of high unemployment, creating additional demand for goods and services that in turn creates additional demand for labor. In this case, the same mechanism would have further tightened a labor market already near full employment and left employers scrambling to attract and retain workers.

In monetary policy, the interest rates established by the Federal Reserve in 2018–19 were also unprecedented. Low interest rates make more capital available more cheaply to businesses and consumers, encouraging them to invest and spend, which again is likely to increase the demand for labor. Traditionally, interest rates are cut during periods of weak economic performance and high unemployment, to deliver additional stimulus, and raised during boom times, lest too much money chasing too few opportunities lead from a boom into a bust. But the federal funds rate averaged 1.8 percent in 2018 and had reached only 2.4 percent in the summer of 2019 when the Board of Governors began announcing cuts. In September 2019, with the unemployment rate at 3.5 percent, interest rates declined. By comparison, in 2004–05, with interest rates near 2 percent and the unemployment rate above 5 percent, the Board of Governors steadily raised rates until reaching 5.25 percent. In 2000, the last time the unemployment rate fell below 4 percent, interest rates exceeded 6 percent.

The dozens of state and local minimum-wage increases in recent years may be another complementary factor that drove wages higher for the labor market’s lowest earners. In 2019, more than twenty states increased their minimums. Economist Ernie Tedeschi has found that the upward wage pressure in such localities could explain about 20 to 25 percent of the wage growth experienced by the lowest third of earners. Without that effect, those earners would be experiencing growth slower than at the middle and top of the distribution; with it, they lead the way.

The dog that has not barked through these aggressive policy experiments is inflation. In theory, massive government borrowing at the moment when private demand for capital should be highest would send interest rates skyrocketing. Suppressing rates by flooding markets with freshly printed bills should devalue the currency. Employers raising wages for employees who have become no more productive should have to commensurately increase prices. But none of this has happened. Instead, inflation has hovered near the target rate of 2 percent, slightly below the average rates for the 1993–2000 and 2001–07 business cycles, suggesting that policymakers had previously misunderstood the economy’s capacity and been short-changing workers, who have the most to gain when they are few and jobs are many.

This strategy cannot continue indefinitely. Real wage growth requires productivity growth, which in turn is likely to depend on real capital investment. If enormous budget deficits leave the federal government as the economy’s primary borrower and “investor,” but that investment takes the form of entitlement and transfer payments, capital formation will suffer. When interest rates make money nearly free, many investors seem encouraged to speculate rather than develop productive assets. Meanwhile, the structural challenges that have driven a long-term, secular decline in male labor-force participation, widening regional divergence, and soaring wealth inequality, all still require redress. The wreckage of the COVID-19 pandemic will only make that harder. Minimum-wage hikes can deliver results when labor markets are tight and when the minimums have gone unchanged for too long, but they cannot be repeated ad infinitum.

Still, economists and policymakers have much to learn from the experience. The concept of full employment requires recalibration, and the tolerance for policies that benefit workers while risking inflation should increase—the burden is now firmly on inflation hawks to find actual harm before reaching a conclusion that the economy has overheated. And while employers have long warned that insufficient labor-market slack or an inadequate supply of immigrant visas would lead quickly to disaster, in fact it appears to lead toward exactly what we want: the long-term unemployed returning to work, investments in training, and rising wages.

The challenge remains to develop an agenda that will deliver those results on a sustainable foundation of rising investment and productivity, providing a framework for supporting broadly-shared prosperity in the decades to come.

Oren Cass is the executive director at American Compass.

The other articles in this series, “What Happened: The Trump Presidency In Review,” published in partnership with American Compass, can be found here:

“Foreword: The Work Remains,” by Daniel McCarthy

Introduction, from American Compass

“Too Few of the President’s Men,” by Rachel Bovard

“A Populism Deferred,” by Julius Krein

“The Potpourri Presidency,” by Wells King

Comments