Hamilton Shrugged

Any good book of history tells a useful tale about the present as well as the past. And a great book of history looks into the future as well. Michael Lind has written such a book in Land of Promise, a volume simultaneously scholarly and entertaining—bereft, blessedly, of graphs and equations. Yet at the same time, the work poses a serious challenge to the contemporary orthodoxies of left and right, offering a manifesto for a future far different from what the policymakers in either political party might imagine.

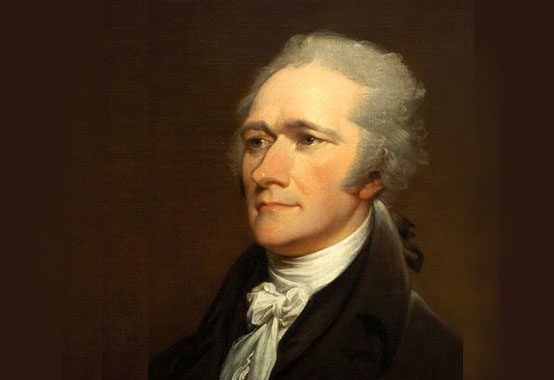

Interestingly, the source for Lind’s future vision is a notable figure from American history, a man admired today as a Founder even as his economic philosophy is mostly ignored—Alexander Hamilton. We might ask: Where would America’s first Treasury secretary find space in the political spectrum of today? Which political party would welcome him? Lind’s answer: there’s no real home for Hamilton today, although there should be.

As a champion of energetic government, eager to pursue developmental economic goals, Hamilton might seem to be on today’s left. But as an enthusiast for business and profit, he might seem to be more on the right. So he is politically adrift, we might say—neither party nowadays is interested in the sort of pro-business economic strategy that Hamilton championed.

The same situation holds true for this book’s author. Lind first came to national prominence in 1995, publishing an article in the left-wing magazine Dissent, “Why Intellectual Conservatism Died,” that scourged the conservative movement for harboring Pat Robertson and his crackpot theories. And today he writes a column for Salon.com. Yet at the same time, Lind must regularly confound his lefty readership by openly disdaining environmentalism, multiculturalism, and contemporary progressivism in general, as he argues for a hard-nosed neo-Hamiltonian revival of American infrastructure and industry.

Thus we come to Land of Promise, which begins with a reminder that the intention of our early leaders—that is, the English government in London—was to make America a permanent agricultural satellite of the mother country. As a 1721 report from the British Board of Trade observed, “Having no manufactories or their own,” the colonists will always be “dependent on Great Britain.”

Perhaps not surprisingly, this vision of America—as nothing more than a land of farmers, growing crops to trade for British manufactures—was appealing to Adam Smith, the great champion of free trade who was also, of course, a loyal Briton. Lind writes crisply, “If America had paid attention to Smith, the United States would never have become the world’s greatest industrial economy—because it never would have become an industrial economy at all.”

To Hamilton, such a future for America was unacceptable. As an officer in George Washington’s army during the Revolution, he had seen that the colonists nearly lost the war for want of adequate military equipment. That weapons deficit, Hamilton believed, should never happen again: for any future wars, the young republic needed its own military-industrial complex. And so Hamilton rejected free trade and non-industrialization in favor of a conscious policy of protectionism and industrialism, nurturing the nation’s “infant industries.”

President Washington, himself a plantation owner, sided with Hamilton, thus going against the regional interests of his fellow Virginians and Southerners. Agriculture-exporting Dixie, after all, saw Hamilton’s tariff as an unfair economic burden, designed to benefit Yankee manufacturers. Yet in Lind’s view, the first president’s largeness of spirit—siding with the Hamiltonian modernizers as opposed to his “home team,” the Jeffersonian agrarians—enabled the United States grow into a world power, not only economically, but militarily.

If Hamilton is the overall guiding light of Lind’s book, Henry Clay is the brightest star of the antebellum period. The author nimbly escorts the reader through the seeming arcana of such antique topics as the First and Second Banks of the United States, as well as various Nullifications and Abominations, all the while pointing toward the creation of Clay’s vaunted “American System,” a strategy of tariffs, “internal improvements”—that is, infrastructure—and national finance.

It was under this American System that such inventor-manufacturers as Samuel Colt, Cyrus McCormick, and Isaac Merritt Singer were able to flourish. Economic development in the U.S., in other words, occurred under a regime that was neither laissez-faire nor bureaucratically ordained; its capitalism arose within a set of business-friendly rules that Hamilton, Washington, and Clay believed to provide the best balance between personal economic liberty and the desired national results. As Lind observes, “Industrial policy is not alien to the American tradition. It is the American tradition.”

And technology also mattered. In Lind’s telling, the American System included a healthy appreciation of its transformational power; technology was what proved crucial to American military success in the Civil War and thereafter. As Lind makes clear, while economic growth is always a desirable goal, what is essential is national survival—and survival is only guaranteed by force of arms.

Echoing Alfred North Whitehead’s observation that the greatest invention of the 19th century was the idea of invention, Lind observes that the world’s leading powers were those that could systematize research and development through either public or private means. So while properly describing Thomas Edison as “brilliant,” Lind adds, “most of the products for which he is given credit, from the incandescent lightbulb to the phonograph and motion picture technology, were the work of engineers he organized into teams in a succession of laboratories.” Edison’s enduring success was the result of the system he created.

Thus once again, Lind enters territory outside of the familiar economic debate of our time. He mostly ignores Milton Friedman and Paul Krugman, for instance, focusing rather on earlier economists, such as Joseph Schumpeter, who saw technological advancement as a force larger even than the market. Indeed, from Edison’s General Electric to AT&T’s Bell Labs to Uncle Sam’s Defense Advanced Research Projects Agency to Stanford University’s multiple engineering spinoffs, Lind correctly notes that the greatest inventions have typically come from public or private bureaucracies—organizations mostly immune from the normal cost-cutting pressures of competition. The prime mover of innovation, Lind argues, is the innovative spirit, not the free market.

Summoning up an out-of-fashion economist, John Kenneth Galbraith, Lind emphasizes again that bigness is not necessarily badness. He supports federal regulation of business, even while criticizing anti-trust laws that seek to limit business size. Lind blames rules against horizontal integration—that is, against a company’s enlarging its market share in a given sector—for the value-destroying conglomerate movement of the postwar era, in which businesses bought other businesses in unfamiliar fields, with predictable negative results. Beatrice Foods, for instance, made 290 acquisitions between 1950 and 1978. Today, the company no longer exists.

Lind hopes that large, technologically proficient corporations will lead to a revival of “Fordism”—Henry Ford’s belief that high profits and high wages can coexist. Indeed, Lind argues that high profits and high wages reinforce each other because workers then have the wherewithal to buy the products they are making. Without endorsing Ford’s political views, Lind sketches out a positive history of Fordist American corporatism, featuring business leaders such as Gerard Swope and Owen Young, as well as political leaders who supported such views, including Theodore Roosevelt, Woodrow Wilson, and even Herbert Hoover. Some of these presidents were more successful than others, but all shared similar ideas about cooperation between business, labor, and the public.

Yet Lind’s hero among 20th century presidents is Franklin D. Roosevelt, whom he sees as an obvious inheritor of the Hamiltonian tradition. Lind concedes that the New Deal of the ’30s was a mixed success but insists that its shortcomings were mostly because it wasn’t big enough. He quotes John Maynard Keynes in 1940: “It seems politically impossible for a capitalistic democracy to organize expenditures on the scale necessary to make the grand experiment which would prove my case—except in war conditions.” In some situations, Keynes is saying, war is the health of the economy.

World War II came to the U.S. soon thereafter and finally, in Lind’s telling, the government fully accelerated the economy. Across the nation, new infrastructure projects were built in record time: Lind recalls, for example, that the Big Inch oil pipeline, connecting Texas to New Jersey, was built in less than six months. Indeed, his enthusiasm for such projects leaves no doubt as to where he stands on the proposed Keystone pipeline of today. But of course, back then, just about everyone was in favor of heavy projects since they were seen as vital to the war effort. In 1941, Woody Guthrie composed an ode to the Grand Coulee Dam: “Now in Washington and Oregon you can hear the factories hum/ Making chrome and making manganese and light aluminum/ And there roars the flying fortress now to fight for Uncle Sam.”

Lind’s point is that needed infrastructure almost always requires the push of national urgency to overcome lethargy, localism, and NIMBY-ism. As the imperatives of Depression, World War II, and Cold War faded, so did necessary Hamiltonian investment. “The Golden Age of infrastructure spending between the 1930s and the 1960s,” Lind writes, “gave way to an era of crumbling bridges and barge-canal locks and traffic and freight congestion, as spending on infrastructure declined.” The national motivation was gone.

Meanwhile, Lind casts an approving eye on other countries that chose a Hamiltonian strategy, notably Japan. He quotes one Japanese trade negotiator in 1955: “If the theory of international trade were pursued to its ultimate conclusions, the United States would specialize in the production of automobiles and Japan in the production of tuna.” If the Japanese had adhered to the doctrines of Adam Smith, they would be a nation of fishermen, not industrialists. In recent decades the economic might of Japan has faded, but Lind makes much the same point about China’s pro-industry policy today: through its currency manipulation and rampant theft of intellectual property, Beijing is confounding free traders and bulking up its economic and military power.

Back on the home front, Lind celebrates the economic regulation that survived the New Deal into the ’40s and beyond, including regulation of the trucking industry, the airlines, and most of all Wall Street. These rules, he believes, boosted the middle class and kept the economy in productive balance. He laments that such regulations were repealed, starting in the late ’70s during the Carter administration. He calls the next three decades “the Great Dismantling,” blaming deregulation for the erosion of wages, the spiking of income inequality, and the reckless speculation that brought on the current Great Recession.

By now it should be evident that Lind’s vision is an assault on the most established schools of thought in America today. Not only should libertarians be horrified but also environmentalists, as well as neoliberals of the Bill Clinton-type who supported the 1999 repeal of the New Deal-era Glass-Steagall banking regulation. What Lind is advocating is a conscious effort to revive the Hamilton-Clay-FDR vision, which he believes would be pro-car, pro-highway, pro-suburbs, pro-income-redistribution, pro-business, pro-labor, pro-growth—all at once.

Looking ahead, Lind argues not only for more technology but also for more energetic government efforts to promote it and distribute its benefits widely. Acknowledging that even if factories were to come back to the U.S. they would likely be staffed by robots, Lind calls for “service sector Fordism”—that is, high wages in labor-intensive sectors such as healthcare. Thus a new middle class is created, as salaries are pushed up by government policy.

Looking ahead, Lind argues not only for more technology but also for more energetic government efforts to promote it and distribute its benefits widely. Acknowledging that even if factories were to come back to the U.S. they would likely be staffed by robots, Lind calls for “service sector Fordism”—that is, high wages in labor-intensive sectors such as healthcare. Thus a new middle class is created, as salaries are pushed up by government policy.

Lind argues that he is simply keeping faith with Hamilton’s original vision, which provided the dominant economic agenda for the first 180 years of U.S. history. Those who disagree are numerous, to be sure—and some of them claim, as well, that they are speaking for Hamilton. Yet those who defend the current orthodoxies of the left and right must explain what went wrong over the last few decades, and they must then show how a repeat of such policies will lead to a better result next time. So far, at least, neither side has convincingly made these arguments to the American people. Thus Lind’s book emerges as a fresh and bold challenge to the status quo.

James P. Pinkerton is a contributor to the Fox News Channel and a TAC contributing editor. Follow him on Twitter.

Comments