Democrats Set the Wayback Machine to the 1930s

For a party that prides itself on its appeal to the young, the Democrats sure have a lot of old ideas. Of course, no conservative would automatically gainsay an old idea, but the Democrats are supposed to be, you know, progressive.

So let’s look at some of their oldies.

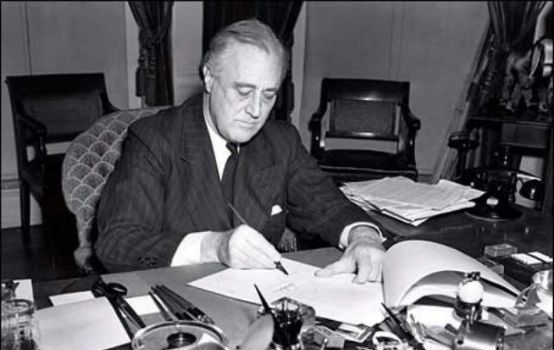

First up: an idea straight out of 1937. In that year, President Franklin D. Roosevelt, fresh from a landslide re-election (he carried 46 of 48 states), which gifted him more-super-than-supermajorities in Congress, also resolved to build a supermajority on the Supreme Court. In previous years, the court, dominated by conservatives, had derailed many of Roosevelt’s New Deal programs. And so the re-elected 32nd president, feeling hubristic, sent to Congress a plan to expand the body from nine to 15 justices—with the idea being, of course, that he could appoint the new six.

Republican opponents immediately dubbed the initiative “court-packing,” and the label stuck. Soon, conservative and moderate Democrats peeled away. And so, despite Roosevelt’s strenuous efforts—including an attempted purge of recalcitrant Dems—the court-packing plan died. Even worse from the White House’s point of view, the public, alarmed by visions of “Caesarism,” punished FDR’s party in the 1938 midterm elections, handing the GOP a massive victory. Indeed, the result was the formation of a bipartisan “conservative coalition” that dominated Capitol Hill for the next quarter century. In other words, the court-packing plan was the most consequential legislative and political failure of the Roosevelt administration.

So perhaps it’s a bit strange that now, eight decades later, “court-packing” is making a comeback in Democratic circles. A March 18 headline in Politico lays it out: “2020 Dems warm to expanding Supreme Court.” As the article details, presidential hopefuls Pete Buttigieg, Kirsten Gillibrand, Kamala Harris, and Elizabeth Warren are all at least somewhat supportive of court-packing.

In the meantime, the rest of us would do well to remember that if one side can pack the Supreme Court, the other side can, too. And so maybe both sides ought to agree to give the Constitution a respite from that sort of drama.

Speaking of the 1930s, we can point to other ideas from that decade that are being dusted off. One is the New Deal—oops, I mean, the Green New Deal. As pitched by Congresswoman Alexandria Ocasio-Cortez and a swelling chorus of Democratic presidential wannabes, the Green New Deal seems to consist of one part concern over CO2 and another part desire to remake the rest of our society. Thus, in addition to the goal of defeating carbon, an early but revealing draft aims at providing free health care, eliminating racism, and guaranteeing “economic security to all who are unable or unwilling to work” [emphasis added].

Or as The Economist put it, “Utopia now.”

If it’s impossible to find a conservative who thinks utopia is doable—or that the Green New Deal is utopia—it’s also hard to find a moderate who thinks such an earthly paradise is feasible. So maybe that’s one reason why Ocasio-Cortez’s national unfavorable rating is now substantially higher than her favorable rating. In the meantime, election-minded Democrats hope without much hope that AOC and her zealous allies will learn to chill.

A second and related blast from the past is the idea of a Universal Basic Income (UBI). This is being pushed most notably by long-shot presidential aspirant Andrew Yang—who, we might note, has accumulated 65,000 donors and thus seems destined to get into the Democratic debates. So a March 15 Washington Post headline wasn’t wrong when it pronounced of Yang, “Haven’t heard of him? You will soon.”

Under Yang’s UBI plan, every American citizen would get $12,000 a year, no matter what. (And yes, were a UBI ever to get near enactment, you can bet there’d be a strong push to get rid of the requirement that one be a citizen to get the money.)

In the meantime, UBI has the support of many prominent lefties, such as former labor secretary Robert Reich. And yes, even some libertarians support UBI. In the meantime, the rest of us can say: if you like welfare dependency, you’ll really love UBI dependency.

Here again, UBI is an idea with a ’30s pedigree. Back then, the Townsend Plan was popular, and so was the Ham and Eggs Movement, and so were Senator Huey Long’s slogans of “every man a king” and “share our wealth.” Fortunately for the fisc, those ideas all stalled before enactment. Interestingly, FDR, while okay with providing government benefits, never wanted to sever the connection between work and reward. As he said in 1935, money-for-nothing schemes are “a narcotic, a subtle destroyer of the human spirit.”

A third idea from the wayback machine is ultra-high income tax rates. Ocasio-Cortez has talked about pushing the top rate to 70 percent; she notes correctly that the top rate was that high or higher for much of the 20th century. Specifically, the top rate was raised from 25 percent to 63 percent in 1932, then to 79 percent in 1936, and then to 94 percent in 1944. Today, prominent economists on the left, including the New York Times’ Paul Krugman, agree that such high rates should be reimposed.

We can say that the rich should pay more—here’s looking at you, carried-interest loophole!—and still be aware that raising rates is not the same thing as actually collecting revenues. That is, behavioral effects kick in, as earners and investors adjust their activity—and their accounting—to beat the rate. That’s the lesson of the Laffer Curve, which has guided Republican economics since the Reagan era.

The issue is that money, especially at the high end, is so, well, liquid that it’s easy for fatcats to push their reported income down below whatever the desired threshold might be—or to channel it overseas.

We can observe that for most of the 20th century, the specters of war, fascism, and communism had the effect of trapping American capital in the U.S.; that is, money just wasn’t safe in most places. And yet today, thanks, ironically enough, to U.S. victories in various hot and cold wars, easily 20 countries and jurisdictions around the world qualify as not just tax havens, but plausible places to hold citizenship, and perhaps even to inhabit.

So while one can lament the ingratitude of tax exiles, what one can’t do—at least not without an extraordinary amount of effort—is collect money from them. To be sure, it’s possible to imagine an international regime in which enforcement and harmonization make tax exiling and other kinds of tax avoidance more difficult, even dangerous. But as we have learned, it’s hard to get the world to agree on much of anything. Moreover, there’s always the concern about killing the goose that lays the golden egg.

So perhaps the better answer is to set reasonable rates and then seek to truly collect revenues from rich individuals and profitable companies that never seem to pay anything. For instance, earlier this year, we learned that Amazon made a profit of $11.2 billion in 2018, yet paid zero federal income tax. Does that seem fair to you? Not to me either. So again, before we go raising rates that chase economic activity out of the country, let’s reform the system such that billion-dollar people and trillion-dollar companies pay at least something.

Moving right along, if we continue our look into the Democrats’ 20th-century memory book—if we delve back even further back, in fact, to the 1920s—we come upon an antecedent to Modern Monetary Theory. MMT, of course, is the voguish notion pushed by Stephanie Kelton, a longtime associate of Senator Bernie Sanders, which holds that countries with their own currency can print all the money they want without ill effect.

Yet Modern Monetary Theory might just as well be called Weimar Monetary Theory, as we recall, without affection, the German hyperinflation of 1921-23. Historians regard that monetary debacle, which wiped out Germany’s middle class, as one of that country’s stepping stones on the road to Nazism.

More recently, the Weimar-ish fate of Venezuela—another country with the freedom to print all the fiat currency it wishes—is also, shall we say, a discouraging indicator.

It does seem that spending and deficits matter less than we were initially told. After all, in the wake of the 2008 meltdown, the Federal Reserve pumped $4 trillion into the economy, and inflation did not tick up. Why not? It appears that in slack times, as we saw during the last decade, the extra money just gets socked away—perhaps in Chinese mattresses. In other words, we could have spent a lot more on, say, productive infrastructure and not paid a price in higher prices.

Yet even if we’ve been over-cautious, fiscally and monetarily, in recent years, the ultimate reality of inflation—that too much money chasing too few goods causes higher prices—is never going to change.

So yes, for many hip Democrats, old ideas are new again. But that doesn’t make them good.

James P. Pinkerton is an author and contributing editor at The American Conservative. He served as a White House policy aide to both Presidents Ronald Reagan and George H.W. Bush.

Comments