Affordable Housing Starts From the Bottom Up

Does affordable urban housing require socialized costs? That’s where I left off a month ago, discussing San Francisco’s tortured housing market and its desperate need for a pressure relief valve of greater density.

Affordable housing is a vast and thorny policy issue, and will be the subject of much discussion here at New Urbs over the next year. A great place to start orienting yourself is the discussion that Emily Badger just collected at the Washington Post, “How to Make Expensive Cities Affordable Again,” and Daniel Hertz’s follow-up thoughts at City Observatory. The Post discussion centers around the displacement of longtime residents in hyper-expensive housing markets like San Francisco, and debates whether new development aimed at the high-end makes housing markets more expensive or less. Market-oriented writers note that high-end construction reduces competition for lower level buildings by the wealthy, whereas others are concerned that the new construction just turns a neighborhood into a magnet for the well-to-do.

I’d like to approach the issue from the other direction, however, by borrowing from Charlie Gardner’s discussion at “Old Urbanist” of the time “When the Market Built Housing for the Low Income.”

Gardner is responding to the idea that “very little private housing in the United States was originally built for low-income people,” meaning that affordable housing almost entirely comes from once-expensive homes that have aged and filtered down the market. And when you survey the current American housing stock, it may well be true that most affordable housing was once premium supply.

But, Gardner takes care to note, absence of evidence is not necessarily evidence of absence:

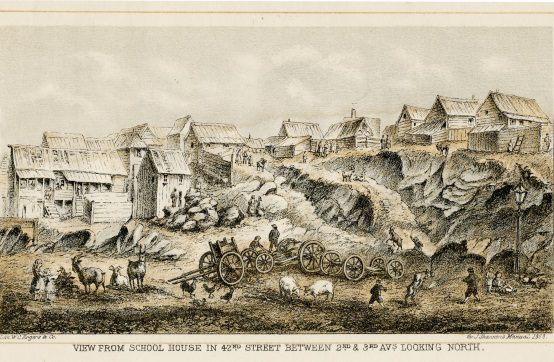

Although this may be somewhat accurate so far as it only applies to formal housing developers, throughout the history of American cities and indeed most other cities in the world, a large portion of the housing stock came from the informal economy, most of it purpose-built for indigent migrants or very poor laborers. This was the case even in some of the largest and wealthiest cities in the Western world until fairly recently.

Prior to the 1920s, the lower end of the housing market was supplied by a combination of pop-up shantys and self-built shacks on low-value land, temporary single resident rentals, small multi-family construction like the proverbial “apartment over the garage,” self-built quality housing like Sears kits, and company-provided housing, among others.

Rather than requiring a wait for upper-class housing to “filter down,” the self-built shacks in particular had a tendency to “filter up,” Gardner says, as people invested in and expanded their homes as they moved up the economic ladder. Even better quality self-built construction was not typically fixed in form upon move-in, but was often subject to a continual, incremental improvement. A small shotgun starter home could be added onto as families and resources grew. But, crucially, people just starting out did not have to pony up all the capital for their final product up front.

What happened to all these components of originally affordable American housing? Simply put, it was often banned, and the evidence torn down. 20th-century reformers seeking to save the poor and working classes from their squalor endeavored to provide safe and sanitary housing while razing the blight of their neighborhood “slums.” It must be acknowledged that the conditions of such neighborhoods were not comfortable or clean, and were often decidedly lacking in plumbing and wiring amenities.

But as Gardner remarks, “the ‘eradication of slums’ element of this strategy was more faithfully carried out than the provision of dwellings.” Gardner summarizes the results:

The elimination of the self-built home as an affordable option in much of the country, in conjunction with zoning regulations limiting small multifamily housing, setting minimum lot sizes and imposing other similar restrictions, completed the elimination of the lower rung of prior housing options.

A few decades after the low-end of the market was cut off with a floor of zoning and code regulations, the upper end of the market, that source of eventual filtered affordable housing, was capped by even further zoning tightening, preventing new development. And so markets like San Francisco and New York have been impossibly squeezed from both directions for generations, leaving a housing supply that is hopelessly inadequate to meet demand. In situations like that, extreme unaffordability isn’t the product of gentrifiers and condo developers; it’s built into the bones of the city.

As the Washington Post discussion demonstrates, there’s a lot of interesting thinking to be done about how the high end of the housing market affects urban affordability. That should not come at the expense of close examination of how the market came to its current state in the first place, however.

When affordable housing structures have been regulated out of existence, affordable housing will necessarily require subsidized provision, as the difference between the market cost of legal housing and the price understood to be affordable are bridged by government. That may come from direct subsidy, housing voucher, or an in-kind exchange with developers, granting permission to build luxury apartments as long a few units are set aside as “affordable.” Acknowledging this situation is a far cry from acquiescing to the inadequacy of unconstrained urban housing production, however.

What is required, then, is a close examination of the state of the American built environment, looking at which rules and regulations are well-considered protections against unsafe corner-cutting, and which are unnecessary barriers to housing access. It will also require a thoughtful consideration of what controls local communities should put in place to shape their city in their own preferred image, and what freedom new residents or developers should have to provide for the underserved or unwelcome.

We’ll look forward to digging into those questions in the coming year, but one guiding principle will be the value of small-scale decision-making and incrementalism. By the time problems are big enough to warrant top-line consideration, they are often too wicked to resolve satisfactorily with the blunt tools large institutions have available. Enabling local responsiveness and relatively low-risk course correction can allow environments to rescue themselves.

Jonathan Coppage is senior staff editor of The American Conservative. New Urbs is supported by a grant from the Richard H. Driehaus Foundation.

Comments