One Cheer For Production Versus Spending

Robert P. Murphy explains the difference between an iPhone5 and a hole in the ground:

[T]he one thing that makes the GDP calculation at least remotely defensible—is that much of the spending is voluntary. So if the iPhone 5 really does bring in the sales figures that the JP Morgan note estimated, then this is prima facie evidence that the consumers derive benefits from the new devices. After all, that’s why they are spending their money buying the thing.

In contrast, if the government spends the same number of dollars, there is no reason to suppose that genuine “economic output” has gone up by the same amount. In the classic example, suppose the government spends the money paying workers to dig ditches and then fill them back up. Clearly, in this scenario there would be nothing to show for the government expenditure.

In fact, the economy as a whole would be poorer, to the extent that the workers would have preferred leisure to digging ditches. If the workers voluntarily accept the ditch-digging job, then the goods they buy with their paychecks must have been redistributed from others, who are now poorer because of the taxes or deficits used to pay the government employees. After all, digging ditches doesn’t create more goods to go around.

Good stuff!

I’m pretty sure, though, that a Keynesian would object to the last paragraph on the grounds that all that has been redistributed is money, not real resources, and money is created by fiat. (And before the goldbugs object: all money is created by fiat, in that “money” is what the government says is legal tender that you can use to pay your taxes. It is useful for money to have no other attributes other than its service as a medium of exchange – so that the economy isn’t shocked, positively or negatively, by, say, the opening of a new silver mine. Once this is conceded, we can move on to arguing about the proper monetary policy, rather than pretending that there is some magic gold wand that could make monetary policy disappear.) On this understanding, a recession is the result of “excessive” demand for money. Print a bunch of extra money and ship it out to poor people, and one of two things will happen.

Either nobody notices that there’s more money around, and the poor people get some “free” stuff. If real resources – particularly labor – aren’t scarce (as they are not in a recession – that’s what a recession means), then nothing has been redistributed – the “free stuff” doesn’t come out of somebody else’s pocket, it is created to meet demand, and replaces idleness (negative value) with productive activity.

Or, the increase in the supply of money is noticed, which in turn leads people to presume that if the economy doesn’t recover soon the authorities will probably print even more money, which will make the money they have been saving even less valuable, which in turn suggests that the thing to do is to save less and spend more – thereby increasing demand, and sparking the recovery that makes further money-printing unnecessary.

That’s the Keynesian story, and Murphy doesn’t say anything to refute it, because he conflates money with real resources. Saving money, and deferring gratification, doesn’t by itself do anything to promote growth. The money has to be turned into capital – invested in productive activity. If it sits in a literal or metaphorical mattress, it does no good at all.

So why do I call for “one cheer” for his analysis?

Because his distinction between capital goods and consumer goods is an important one:

By saving out of present income—by living below their means—people “free up” scarce resources that no longer need to be used up to make burgers, iPods, and sports cars. Instead, these resources can be redirected into making tractors, drill presses, and microscopes for drug researchers. Rather than making consumer goods for present wants, the economy cranks out capital goods to cater tofuture wants. This is the physical analog of how the economy as a whole grows, just as an individual household’s bank balance grows with constant saving.

When real resources are scarce, an hour spent producing consumer goods is an hour not spent producing capital goods, while the opposite is not true (because the capital goods will enable the economy to produce more consumer goods more quickly in the future). So deferring consumption is what makes the application of capital to increase productivity possible.

But when real resources (particularly labor) are abundant, the relationship no longer holds. If there are many slack labor hours available, then the economy can produce more consumer goods with no reduction in capital-goods production.

So the Keynesian prescription makes perfect sense – assuming that Keynesians are right about investor behavior when the government gooses demand. But what if that assumption is wrong?

Let’s go back to that hypothetical where the government prints a bunch of money and hands it out to poor people to boost their consumption, and thereby spur a recovery. I said there were two possible responses: either nobody would notice, and the additional stuff would be genuinely free, inasmuch as idle resources were put to use, or people would notice the increase in the money supply and they would be marginally more inclined to spend rather than save, thus producing more demand.

But that’s not a complete list of what can happen. Expectations of future inflation could spur more saving rather than less – just as a hike in tax rates could spur people to work more hours rather than less – depending on whether their decisions are driven by a hard future income target or by the relative utility of savings versus spending today. That’s a psychological question, but in a recession, when investment and spending decisions are primarily fear-driven, the “hard future income target” psychology makes a lot more sense, while it’s in periods of above-average inflation that I’d expect people’s short-term spending decisions to be driven primarily by expectations of future price increases. All of which suggests that it’s harder than Keynesians would like to think to spark a virtuous cycle of demand and investment – there may well be negative-feedback loops that frustrate their best-laid plans.

Moreover, even if demand increases, what will it be demand for – and how sustainable will it be perceived to be? If the demand is primarily for low-end consumer goods, and the demand is perceived to be artificially inflated (whether or not “artificially” has any more real meaning than “excessive” – economics at this scale always reduces to psychology), then businesses will respond by shortening their investment horizons – which means investing less in capital improvements. That’s how a short-term softening of the recession can trade off with a long-term drag on growth prospects.

So what is to be done? Are the Austrians right that there’s nothing you can do about recessions – you just have to “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate?”

I don’t think so. Rather, this is the reason that I keep arguing in this space that the long term and the short term are related. To shorten the tenor of a recession – particularly a recession that follows a financial crisis – the government needs to do more than just goose short-term demand. Precisely because financial crises are triggered by the sudden realization that short-term demand has been running ahead of that potential, it needs to change expectations about the long term growth potential of the economy.

“Excessive” demand for money, after all, can be understood as “excessive” risk-aversion. If all the government does is try to engineer an increase in consumer demand in the face of widespread indebtedness, that is likely to increase perceptions of future risk, which won’t solve the risk-aversion problem at all – it would exacerbate it.

That doesn’t mean there’s nothing the government can do. Rather, the proper role of government in a recession is to do what the private market is, in a recession, more reluctant than usual to do – increase the scale of its investment in the future productive capacity of the economy.

Murphy is correct that paying people to dig ditches and then fill them up again is a waste of resources, and no road to recovery.

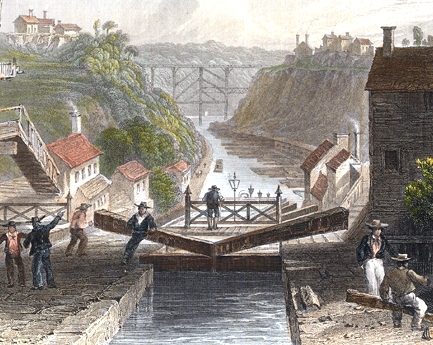

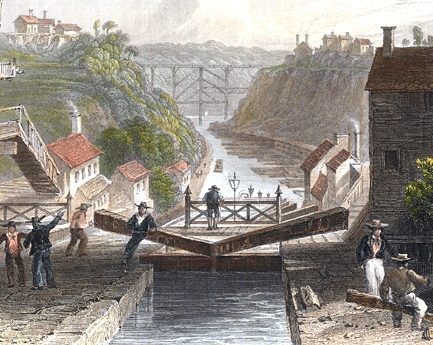

But lay those ditches end to end from Albany to Buffalo . . .

Comments