Not-Very Transparent Aluminum

Sorry, Matt Yglesias, that’s not an adequate explanation of what’s going on with Goldman’s aluminum warehouses.

Here, it seems to me, are the more salient points from Izabella Kaminska’s explanation in the FT. First, the setup:

- “Contango” means that forward prices are above the expected future spot price. In a perfectly efficient market, all non-perishable commodities should be in contango because it costs money to warehouse a commodity, and there should be an equivalency between buying the commodity now and warehousing it versus buying it forward – in either case, you should be paying the financing costs in addition to paying for the physical commodity.

- Markets went into extreme contango in 2008 because of the financial crisis, which make it exceedingly expensive to finance all kinds of transactions. The arbitrage that would bring down forward prices – buying the physical commodity, warehousing it, and selling it forward – wasn’t doable by most market participants because they couldn’t get financing.

- But banks were getting financing through the Fed, so they could either finance other market participants seeking to do the arbitrage, or take their place. That’s how Goldman wound up buying a bunch of warehouses.

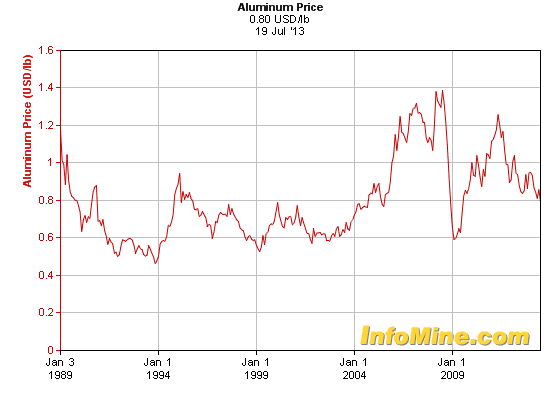

All of that is good – having somebody step in to execute the arbitrage prevented even greater disruptions in the commodity markets. Take a look at the chart of aluminum spot prices since 1989 at the top of this post. Take particular notice of the vertical line towards the end of 2008. Now imagine how much more vertical that line might have been if there were no speculative commodity buyers, because nobody would finance them.

So far so good – but then things get less-favorable to properly-functioning markets. To quote Kaminska:

-

The process creates the means by which speculation does end up driving and influencing physical prices (rather than being priced off physical realities)

-

There is a fiduciary issue because banks have an incentive to maintain the illusion of physical scarcity to mislead investors. . . .

-

The dark inventory hoards can be used to the trading advantage of the banks.

In other words: the banks have an information advantage by virtue of being the only ones who really know how much of a physical commodity they own, and they are also particularly well-placed to take advantage of that information advantage – much better-placed than an ordinary speculator who didn’t have investor clients or market-making responsibilities. It seems to me that one obvious solution would be to restrict the banks from taking the metal “off-warrant” – but I don’t know enough about these markets to know what would be the other consequences of doing that, nor who would be the proper authority to impose such a restriction.

It also sounds, though, like there’s some kind of persistent arbitrage in the warehouse fees. If I understand correctly, Goldman makes money both by owning the aluminum and by warehousing other speculators’ aluminum. In both cases, they want the metal to remain off the market because they want spot prices to rise relative to forward prices (i.e., to move toward backwardation) because they are “long” spot and “short” forwards. In order to induce other participants to join them in hoarding metal, they pay them incentives – in effect, a rebate of warehousing fees. But if all their “tenants” got a fair-market rebate, there would be little advantage to maintaining the trade. So there must be some degree of information advantage on that end of the trade as well, where at least some clients of their warehousing service are paying more than they “should” for warehousing because of lack of transparency in pricing – or because switching to another warehouse would “expose” their holdings. Again, I don’t know enough.

The bottom line, though, is very simple. Banks have a natural – and proper – financing advantage over other businesses, because they are in the business of providing financing, and receive it on favorable terms from the government for that reason. Dealers have a natural – and proper – information advantage over other market participants, because they necessarily gather information as a consequence of their market-making activities. An institution that is allowed to be a bank, a dealer, a speculator and a real service-provider to market participants is therefore in a very formidable position to extract rents. Regulatory oversight should respond appropriately to that situation where it cannot be avoided.

Comments