The Myth of British Austerity

One of the problems with economic policy analysis is that pundits on both sides create their own versions of reality. A good example of this is economist Paul Krugman’s treatment of the British government’s spending since the financial crisis. As a Keynesian, Krugman of course thinks that massive government budget deficits are necessary in these times of depressed demand and a “liquidity trap.”

To ostensibly demonstrate how right he is, Krugman has repeatedly pointed to the British experience. According to Krugman, the Brits did what all the right-wingers wanted, and slashed spending in order to rein in deficits. Yet this led to a double-dip recession, just as Krugman warned. There’s just one problem with this argument: The British didn’t actually cut spending, and their fiscal pattern is quite similar to that of the U.S.

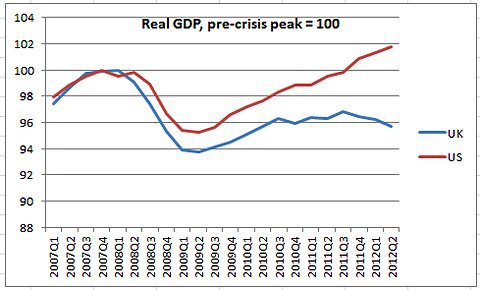

Before making my case, let’s quote Krugman in his own words. In a September 3, 2012 NYT blog post titled, “Britain’s Paul Ryan,” Krugman produced the following chart and commentary:

In a lot of ways George Osborne, the Chancellor of the Exchequer (finance minister) is Britain’s answer to Paul Ryan. True, he’s a toned-down version — no Ayn Rand, please, we’re British — but other aspects of package are there in full force: he’s articulate, has a vision that’s completely at odds with everything we actually know about macroeconomics, and he was for a while the darling not just of the right but of self-proclaimed centrists on both sides of the Atlantic.

Osborne’s big idea was that Britain should turn to fiscal austerity now now now, even though the economy remained deeply depressed; it would all work out, he insisted, because the confidence fairy would come to the rescue. Never mind those whining Keynesians who said that premature austerity would send Britain into a double-dip recession.

Strange to say, Britain’s recovery stalled soon after Cameron/Osborne began their new policies, and the country is now in a double-dip recession.

Now for Krugman’s story to really make sense, you would expect that the United States had continued with Keynesian policy recommendations, in contrast to the draconian budget-slashing of the British government. In that case, the fact that the United States recovery—though tepid—continued through 2010 and 2011, while the UK fell back into official recession, would be prima facie evidence in Krugman’s favor.

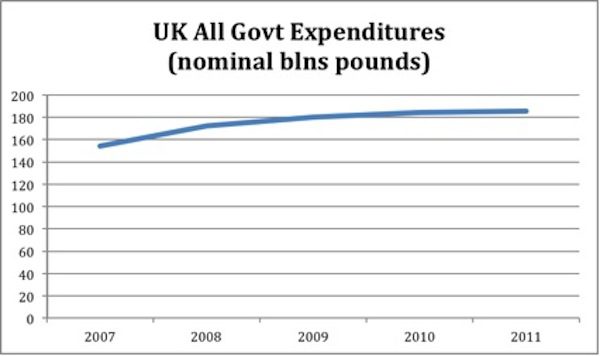

Yet as I said in the beginning of this article, the problem with Krugman’s narrative is that the British never actually cut spending. As so often happens in government, the British merely slowed the rate of increase, at least if we are considering all levels of government combined. (Long-time readers of Krugman know that this is his preferred metric. If I had focused on merely federal expenditures, then a Krugman fan would accuse me of cheating.) Here is a chart showing absolute expenditures in nominal terms (i.e. not inflation-adjusted) at all levels of government in the United Kingdom, calculated with data from Eurostat and the Guardian:

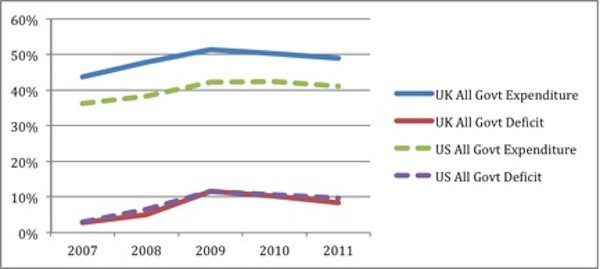

It’s also revealing to compare the UK with the US, both in terms of total government expenditures and total government budget deficits, as shares of the economy:

As the above chart demonstrates, the total government budget deficits (as shares of the economy) were quite similar throughout the crisis in both countries. It’s true, the deficit in the UK was smaller in 2010 and 2011 than in the US, but the contrast is hardly a stark one. If Krugman thinks the above chart shows the folly of budget austerity, a conservative could just as easily say it shows the dangers of excessive government spending, which was consistently higher in the UK throughout the whole cycle.

I do not deny that some right-wing pundits pointed to George Osborne as a role model before Britain fell back into recession, but to my knowledge they were mostly journalists, not Chicago School or Austrian economists. Indeed, I know that many in these camps explicitly warned against the large tax rate hikes that the British government implemented in the name of fiscal austerity. These economists could now pat themselves on the back with as much justification as Krugman, and say they predicted that a tax hike on “the rich” would backfire in the UK, raising less revenue because of Laffer Curve effects. Yet Krugman himself has no problem with raising taxes on “the rich” in the US, despite this apparently obvious lesson from overseas.

This episode underscores the ease with which economists can use data to support just about any narrative they want. To take a well-known example, Christina Romer and other Keynesian economists designed a stimulus package for the incoming Obama Administration that was supposed to limit the rise in unemployment to under 8 percent. When that prediction turned out to be awful, the Keynesians explained it away by saying the economy was worse than they realized. Krugman himself threaded the needle by (a) congratulating himself on predicting that the stimulus would be too small while (b) praising “Big Government” (his term) in the summer of 2009 for rescuing the economy from depression.

My point in all of this isn’t to accuse Krugman and other Keynesians of willful dishonesty. Rather, my point is that they seem so sure that the data are on their side, when they don’t see how their worldviews allow them to deal with any problems. For example, in this article I show how Krugman literally had to explain away at least 9 different examples (!) of governments successfully engaging in fiscal austerity without wrecking their economies.

In macroeconomics, there are no controlled experiments. There are always a million different things changing, and so a committed Keynesian can always come up with a story such that the data “confirm” his worldview. This danger exists for other economists too, but the great virtue of the Austrian School—of which I consider myself a member—is that they seem more aware than others of the limits of empirical back-patting in this arena.

Robert P. Murphy is author of The Politically Incorrect Guide to Capitalism. His blog is Free Advice. Follow him on Twitter.

Comments